It is typical for Social Security benefits to be 85% taxable, especially for clients with higher income sources in retirement. But the benefit subject to taxation can be lower. Depending on income levels, taxable Social Security can be 0%, 50%, or 85% taxable. However, there are certain elements that make taxation of benefits not as simple as 0%/50%/85%.

The highest portion of social security benefits subject to taxes is 85%, while 0% is lowest, depending on provisional income. The provisional income is the adjusted gross income, plus tax-free interest, less Social Security benefits, plus one-half of Social Security benefits. The following ranges of provisional income determine the maximum taxable Social Security.

- Less than $25,000 single/$32,000 joint: 0% taxable.

- $25,000 to $34,000 single/$32,000 to $44,000 joint: up to 50% taxable.

- Greater than $34,000 single/$44,000 joint: up to 85% taxable.

Moneytree Advise always assumes that 85% of the Social Security benefits is taxable to be most conservative (and straightforward). When running Aspire reports in Moneytree Plan, the advisor sets the taxable percentage between 0%, 50% or 85%. Prosper reports determine the taxable Social Security each year, thanks to the detailed tax analysis built into the projections. As a client’s provisional income changes, the amount of Social Security benefits subject to taxes can change too. The taxable amount determined by the projection displays on the Social Security Worksheet (report D16), then carried to the Taxable Income Analysis, column 6 (report D7).

There are two calculations to determine the taxable Social Security. Compute them both and use the smaller of the two.

Method 1 – 85% of the SS benefit (maximum taxation)

- This one is easy – social security benefit times .85 is the maximum amount of taxable benefits.

Method 2 – Provisional Income*

Note: this not the formal way of completing the calculation from tax documents, but works to derive the right amount quickly.

- For clients with provisional income over $32,000 and under $44,000 (joint)

- The provisional income between $32,000 and $44,000 (joint) is taxed according to the pre-93 rules at 50%

- Provisional income – 32,000 x .5 = taxable social security

- For clients with provisional income over $44,000 (joint)

- A) The portion of income between $32,000 and $44,000 is taxed according to the pre-93 rules at 50%, amounting to $6,000 of taxable social security

- $44,000-$32,000 = $12,000 x .5 = $6,000

- B) The provisional income over $44,000 (joint) is taxed according to the post-93 rules at 85%

- Provisional income – 44,000 x .85 = additional taxable social security

- C) Add pre-93 rules taxable social security of $6,000 (A) + additional amount of taxable social security for provisional income over $44,000 according to the post-93 rules (B) for the total taxable social security

- (A) + (B) = total taxable social security

- A) The portion of income between $32,000 and $44,000 is taxed according to the pre-93 rules at 50%, amounting to $6,000 of taxable social security

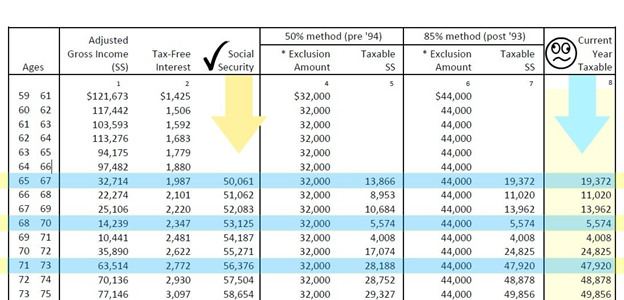

* Provisional Income (PI) is calculated as the AGI Less Social Security benefits plus Tax-Free Interest, plus 1/2 Social Security benefits. On the Taxable Social Security Report: PI = Column 1 + Column 2 + 1/2 Column 3 (Column 1 already shows the AGI Less the Social Security benefits).

Example

Let’s look at an example report to run through the calculations for three years where the portion of Social Security subject to taxation varies from a low of 10% to a high of 85%.

- For age 65/67, social security benefits total $50,061, and the taxable portion is $19,372 (39%)

- For age 68/70, social security benefits total $53,125, and the taxable portion is $5,574 (10%)

- For age 71/73, social security benefits total $56,376, and the taxable portion is $47,920 (85%)

The amount of Social Security subject to taxation changes as the provisional income changes. We can see the pieces that make up the clients provisional income on the Taxable Social Security Worksheet (D16). The AGI included in Column 1 is already reduced by the Social Security amount, half of the benefit in Column 3 must be added back in.

Calculations

For each age we calculate taxable Social Security, the correct value will be in bold.

Age 65/67

Social security benefits total $50,061, and the taxable portion is $19,372 (39%)

Method 1 = $42,552

- $50,061 * .85 = $42,552

Method 2 = $19,372

- Provisional Income (PI) = $59,732

AGI $32,714 reduced by SS + Tax Free Interest $1,987 + ½ SS $25,031

- The clients provisional income is over $44,000

A) PI between 32,000 and 44,000 x .5 = $6000

B) (PI $59,732 – $44,000) x .85 = $13,372

C) (A + B) = $19,372

Age 68/70

Social security benefits total $53,125, and the taxable portion is $5,574 (10%)

Method 1 = $45,156

- $53,125 * .85 = $45,156

Method 2 = $5,574

- Provisional Income (PI) = $43,149

AGI $14,239 (reduced by SS) + Tax Free Interest $2,347+ ½ SS $26,563 - The clients provisional income is between $32,000 and $44,000

(PI $43,149 – $32,000) x .5 = $5,574

Age 71/73

Social security benefits total $56,376, and the taxable portion is $47,920 (85%)

Method 1 = $47,920

- 56,376* .85 = $47,920

Method 2= $48,903

- Provisional Income (PI) = $94,474

AGI $63,514 (reduced by SS) + Tax Free Interest $2,772 + ½ SS $28,188 - The clients provisional income is over $44,000

A) PI between 32,000 and 44,000 x .5 = $6000

B) (PI $94,474– $44,000) x .85 = $ 42,903

C) (A + B) = $ 48,903