Moneytree Solutions

Our brand new, game-changing financial planning solution helps you create accurate plans, quickly.

Experience the new Moneytree

Accurate. Comprehensive. Transparent.

The new Moneytree’s straightforward user experience allows you and your clients to align on objectives and strategies faster and achieve more.

ACCURATE: Build dependable plans backed by the strongest calculation engine on the market.

COMPREHENSIVE: Provide next-level service and grow your business.

TRANSPARENT: Be a hero to your clients and facilitate their financial freedom.

Nurture trust with the leader in accuracy and transparency

AUDIT TRAIL: Build relationships founded on integrity. Moneytree guides you through calculations, allowing you and your clients to see the figures used in the plan.

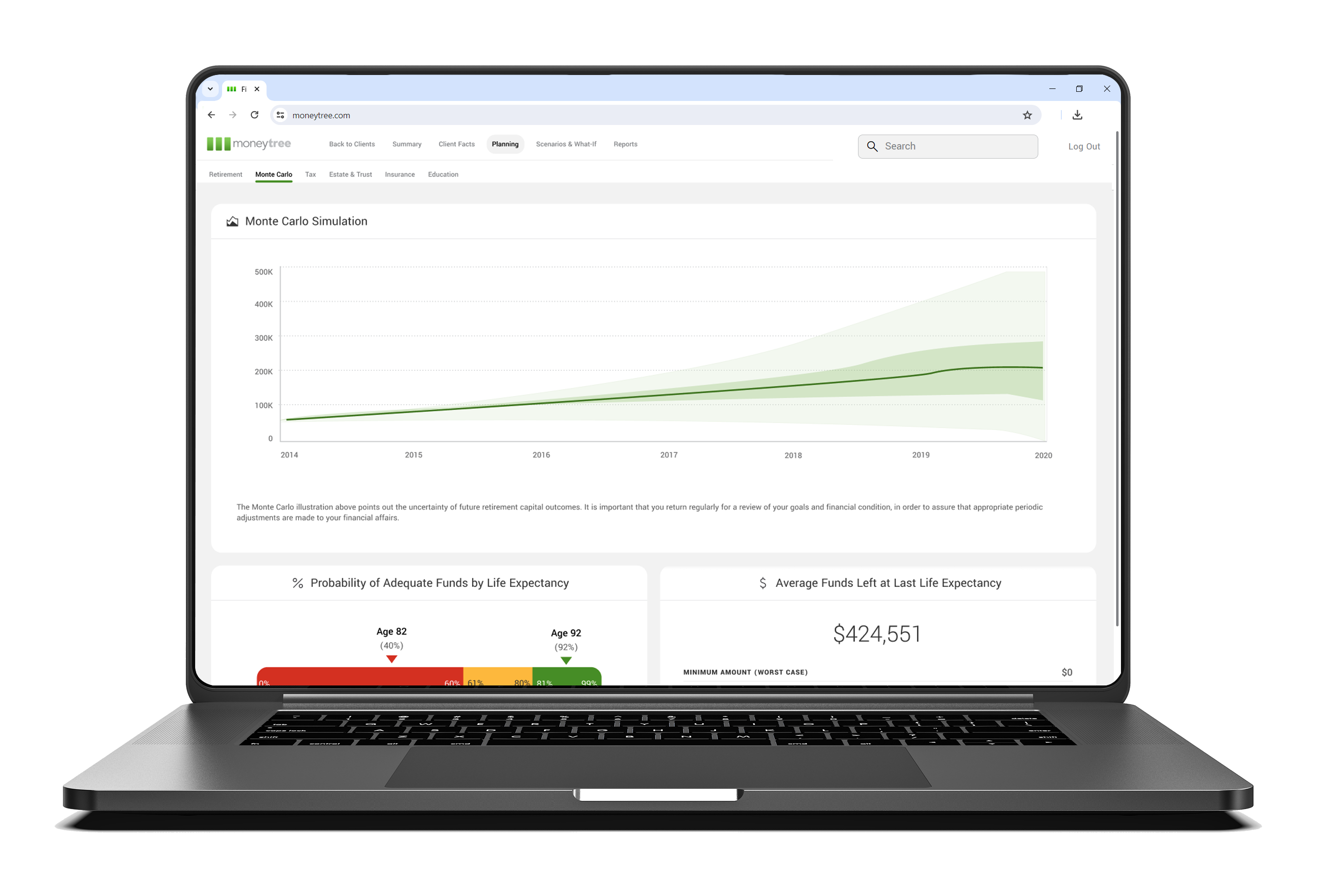

MONTE CARLO: Run 10,000 simulations—10 times more than our competition. That way your clients can be even more confident about your recommendations.

FULLY CUSTOMIZABLE WITHDRAWAL ORDER: Easily compare outcomes of different withdrawal order strategies.

CASH FLOW AND GOAL-BASED OPTIONS: Offer a planning method tailored to the specific needs of your clients, allowing them to build wealth, retire comfortably, and lead a fulfilling life along the way.

Prioritize relationship building

BEST-IN-CLASS REPORTS: Engage clients with reports that are as easy for you to create as they are for your clients to understand.

ONE-PAGE SUMMARY: Build trust and focus client awareness on areas that need the most attention. A perfect leave-behind for any client meeting.

CLIENT PORTAL: Exceed expectations with on-demand account access for your clients that includes account aggregation from MX to ease data-gathering efforts.

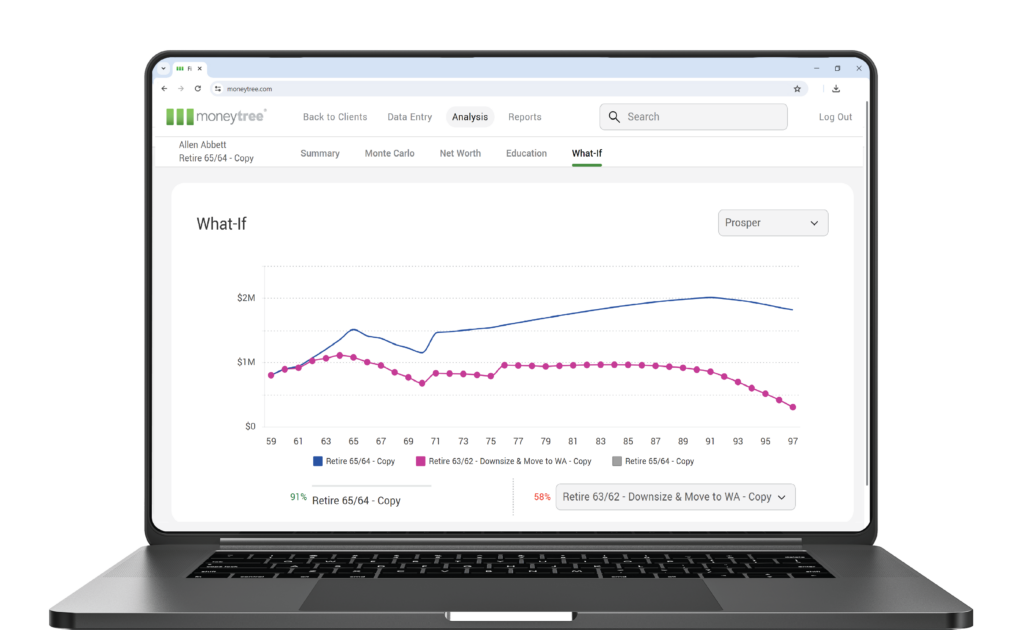

INTERACTIVE WHAT-IF SCENARIO TOOLS: Encourage client collaboration during plan creation and help them understand options for the retirement that best fits their lifestyle.

Save time and money with one solution

PLANNING PAGES: Compare projected outcomes directly in-line, allowing you to quickly compare implications of your investment, saving, and tax strategies.

FUTURE CHANGES TABLE: Capture and account for client lifestyle choices. Using this feature, determine the year, event, and outcome to create the most accurate plan for your client.

SPECIALIZED PLANNING TOOLS Perform a wide range of functions within the Elite level new Moneytree, including:

- Business ownership

- Education planning

- Estate planning

- Life insurance analysis

- Retirement distribution

- Risk assessment

- Roth conversion

- Social Security review

- Tax preparation

- Options planning

Other tools for financial advisors

Moneytree Advise®

Serve more accumulation-phase clients with streamlined, goal-based plans.

FINANCIAL LITERACY: Introduce financial planning to new clients and work toward debt-reduction.

EFFICIENCY: Create and update more plans faster with our most streamlined solution and assumptions-based methodology.

ENGAGEMENT: Impress clients with clear reporting and side-by-side scenario comparisons.

SUCCESS: Prepare clients for successful retirement with tools for analyzing retirement capital, summarizing retirement expenses, and more.

Moneytree Merit

Go deeper in client conversations by showing them how to meet their goals.

RISK AND RETURNS: Build and compare portfolios to assess the best risk/return profile for your plans.

ANALYTICS: Review and analyze portfolios based on risk, holdings, and geographic distribution.

MARKET SCENARIOS: Compare multiple scenarios based on portfolio strengths, weaknesses, and historical data.

COMPARISONS: View and present the results in a streamlined, visual way.

Scale your business with our integrations

You can easily connect with other programs in your tech-stack to support account aggregation, customer-relationship management, investment analytics, risk tolerance, and more.

Increase profitability and efficiency through our partnerships

We can help you grow your business and improve the client experience thanks to our extensive network of broker-dealer partnerships and other industry affiliations.

If you’re registered with one of our broker-dealer partners or other affiliated organizations, you qualify for a discount on Moneytree. Another advantage is that Moneytree clients can easily import client and asset information from our partners.