Getting to know Tony Pantello

Moneytree has always been a powerful and accurate platform that users have relied on to provide financial planning services to their clients. Foundationally, the platform is still all about precision. But with Moneytree’s new platform, you interact with that powerful core system in a way that is more satisfying, more time-effective, and more impressive for […]

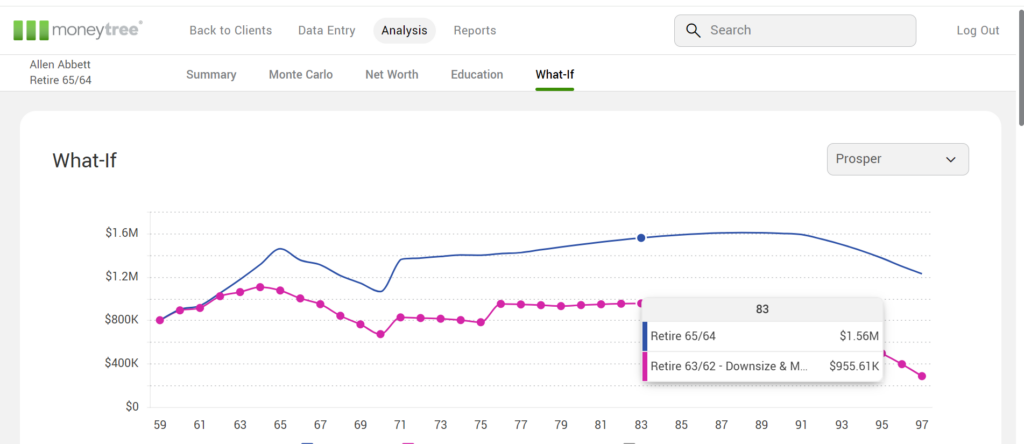

5 tech tips for the What-If tool

All Moneytree online planning applications include a powerful “What-If” tool that allows you to make on-the-fly adjustments to see how various plan changes could impact your clients’ futures. It will provide the expected projected capital based on fixed-rate assumptions, along with a Monte Carlo simulation based on annually randomized rates of return. The What-If is […]

3 ways to build credibility with the new Moneytree

Ethos. Gravitas. Whatever word you want to use, the point is, clients trust you when they believe you are credible. You know what you are doing, and the new Moneytree provides tools to help you showcase that. Here are three ways you can build credibility using the new Moneytree. 1. You can easily answer “Where […]

Scalable. Secure. Accessible. Why cloud software is right for your business.

Are you happy with your desktop software? Even if the answer is yes, there are substantial business reasons why you should consider making a change to a cloud-based platform that you access online. Applications installed directly onto your computer are quickly becoming an old way of operating, and continuing to work this way can make […]

What the new CFP tech guide is all about

If you’re a Certified Financial Planner, you have proven that you have what it takes to help clients achieve their financial goals. You’re principled. You’re experienced. You’re intelligent. You’re accountable. But what about the software you use to apply your knowledge and expertise to real-world situations? Does your technology meet professional standards, too? And what […]

Talking about tech bloat with Pat Spencer

Advisors are frustrated with their tech stack. A recent Michael Kitces survey noted that, overall, advisors report a satisfaction rate for their entire tech stack at 7.3 on a 10-point scale. Not bad, perhaps. But what’s especially revealing is that they rate each individual component of their tech stack higher—at an average of 7.6. So, […]

Flexible withdrawal order in Moneytree

Your clients have complex financial lives, and that includes their taxable, tax-free, and tax deferred income strategies. Distribution strategies are highly personal. For example, your clients may hold a charity near and dear to their heart. Maybe their medical expenses are accumulating, or maybe they just don’t know the best way to handle their tax […]

4 important questions to ask when buying software for your business

Buying new software is a big investment, but with so many options, it can get overwhelming quickly. In fact, according to Capterra’s 2022 SMB Tech Trends Survey, 61% of small and medium businesses in the US have experienced buyer’s remorse over a technology purchase they made in the past year. It’s tough to know what […]

Moneytree Merit – Why are we doing this?

Not long ago, someone asked me why Moneytree decided to launch Merit. There are multiple levels to my answer. On a philosophical level, our company purpose statement is that we are here to “Make great things happen for other people.” That includes helping you build your clients’ investment portfolios with the best personalized chance of […]

Garrett Planning Network and Moneytree — a partnership based on shared values

Values matter at Moneytree. We don’t just jump into business with anyone. We look for partners who believe in a greater good and are passionate about lifting up others. That’s why we are proud to have sponsored the Garrett Planning Network’s Advisor Retreat, Oct. 17-18, in Louisville, Kentucky. Founded in 2000, the Garrett Planning Network […]