Engaging your clients in the creation of their plan can help them learn and understand their financial models. The What-If tool lets the client test different scenarios without the risk of overwriting existing information.

Adding What-If to Moneytree Plan’s Client Access Portal allows your clients to gain control in changing their plan information without making permanent changes to their accessed plan. You can set up a Simple or Advanced What-If view for your clients to access, depending on their comfort levels.

When setting up a client’s access portal, there will be an option labeled “Enable Advanced What-If.” Checking that box will allow clients to make changes to almost any plan assumption in the What-If. If the box is unchecked, they will still be able to access the simple What-If view.

After setup, the What-If they view can be changed at any time by going to the “Modify Client Access” tab from the client’s planning scenarios section.

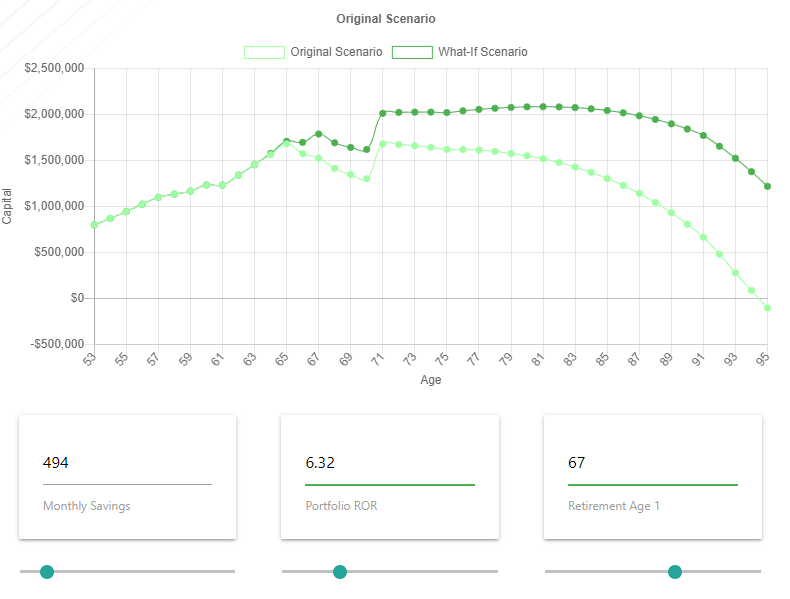

Simple What-If

The simple What-If allows clients to change major plan assumptions. When they make changes, they can use the “Update” button to see the results. Their results will reflect the report they can generate. If an Aspire report was chosen, this projection will use goal-based report assumptions. If a Prosper report is chosen, it will represent the cash flow report assumptions.

Clients will be presented with 7 major datapoints:

- Monthly Savings: This will start with the combined additions into all assets.

- Portfolio Rate of Return (ROR): Starting at the weighted average return across all their assets, clients can adjust the portfolio returns between 0% and 20%

- Lump Sum Savings: This will always begin at $0. Clients can use this to determine what their results look like if they received a sum of money that they could invest this year

- Retirement Expenses: The starting value here will be determined from the total personal expenses for the client at retirement.

- Retirement Ages: For both individuals 1 and 2

- Social Security Start Ages: For both individuals 1 and 2, this will start at a value determined by inputs; this field is disabled if their plan is optimizing Social Security

- Life Expectancy: For both individuals 1 and 2

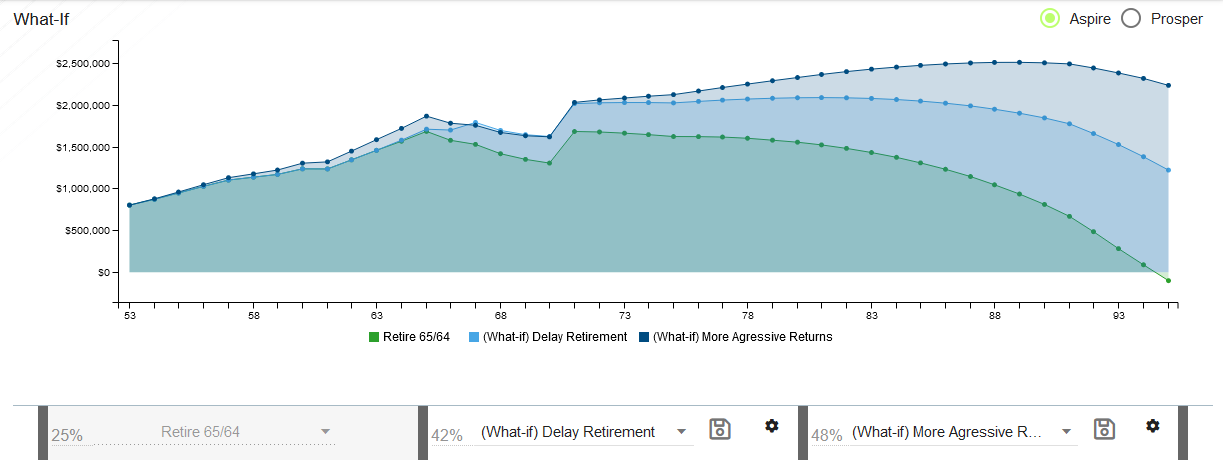

Advanced What-If

The advanced What-If allows clients to adjust almost any plan assumptions. It will have the same layout and appearance as the What-If that is available to you.

For example, the simple What-If only allows clients to change their total current savings and their portfolio returns. In the advanced What-If, they can change their additions to any asset and modify their return assumptions for every asset.

Clients can do the following in the advanced What-If view:

- Change almost any plan information

- Control over where money is saved

- Control over their asset returns

- Add future changes to control timing of events

- Change between Aspire (goal-based) and Prosper (cash flow) projections

- Save What-If scenarios which advisors can review

- Generate What-If reports

- Compare 2 What-If scenarios to the main projection

- View the Monte Carlo success rate

With the What-If tool in their personal portal, clients will have a space to interact with their model without the risk of overwriting the information in their plan. Through this interaction they can gain a deeper understanding of their model, whether they make simple or complex changes.