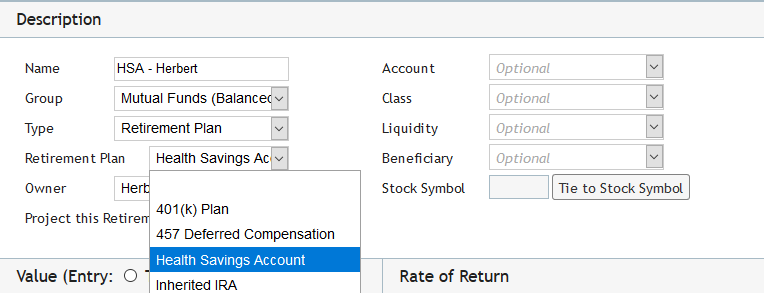

HSAs have been added to Moneytree Plan! Find the Health Savings Account option among the list of Retirement Plan types.

Summary:

Health Savings Accounts (HSAs) provide a number of tax benefits that make them attractive:

- Contributions are fully deductible up to the limit for the year.

- No taxes on annual growth.

- No taxes on withdrawals for medical expenses. This means potentially no taxes on money going into or out of the account.

- No penalty taxes on early withdrawals for medical expenses.

- Pay ordinary income taxes on withdrawals for non-medical, similar to an IRA.

With these benefits there are some drawbacks:

- Penalty taxes of 20% apply to withdrawals for non-medical expenses prior to age 65. Compare this to the 10% penalty before age 59.5 for other retirement plans.

- Like other retirement plans, there are limits:

- Single Individual: $3,550 in 2020.

- Family: $7,100 in 2020.

- Not all medical expenses qualify for tax-free withdrawals.

Behavior in Moneytree Plan:

In Moneytree Plan, withdrawals made to cover medical expenses will not be taxable. Only expenses entered in Itemized Deductions will not be taxable. Medical insurance premiums are not qualified medical expenses for HSAs in the program.

All scheduled withdrawals are qualified distributions. They will not be subject to ordinary income taxes or penalty taxes. This allows for greater flexibility with data entry. For example, if a client has an expensive procedure, you can model the expense in Other Expenses. The procedure can then be paid for by scheduling withdrawals from the HSA. That withdrawal will be tax free.

You can enter both personal and company contributions. Even though HSAs have contribution limits, Moneytree Plan will treat any personal contributions as tax deductible, even if the total exceeds the limit.

In the event of a shortage that causes asset withdrawals, the program will first use the HSA to cover medical expenses. After the medical expenses, or if the clients have none entered, then the HSA will be the last asset used to cover the shortfall.