Annual updates to TOTAL’s state tax information will be rolling out on July 16 for all users who have elected for automatic state tax updates. Automatic updates to state tax information are only available for TOTAL Online users. For desktop users or those who wish to update their state tax tables before July 16, the information is currently available to update whenever you wish.

Updating State Tax Information

To review current state tax information got to Settings > State Tax. There is a button titled “Reset All State Tax Settings.” Click it to immediately update all state tax information for your account.

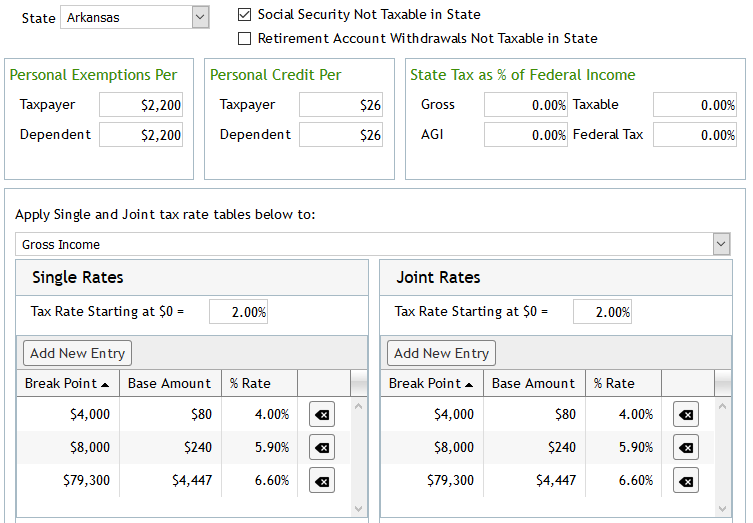

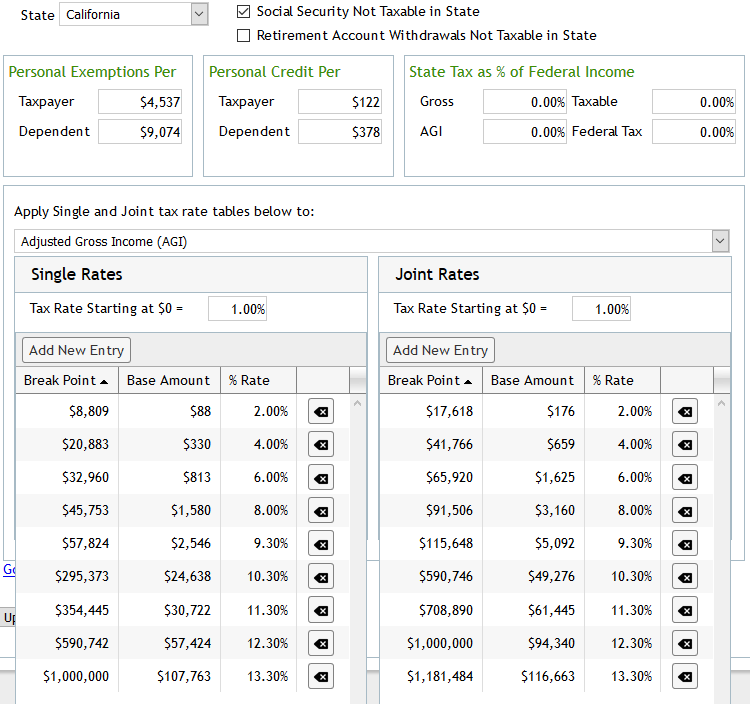

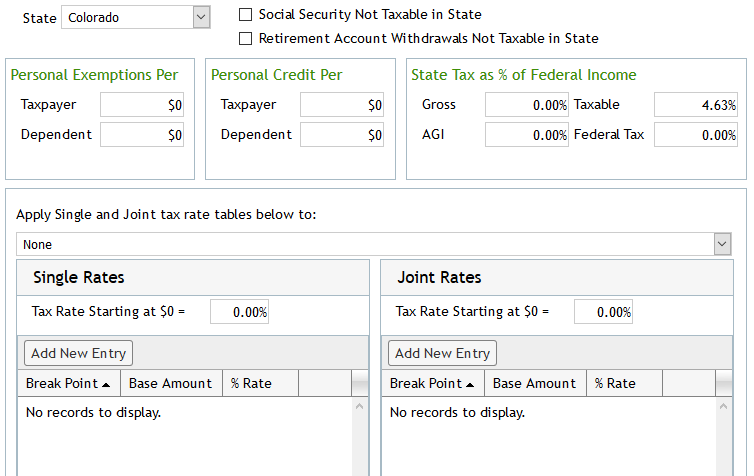

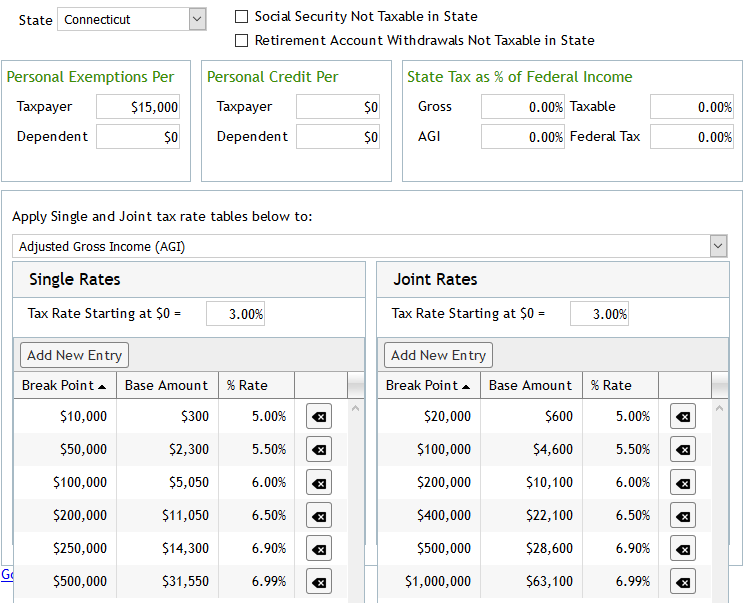

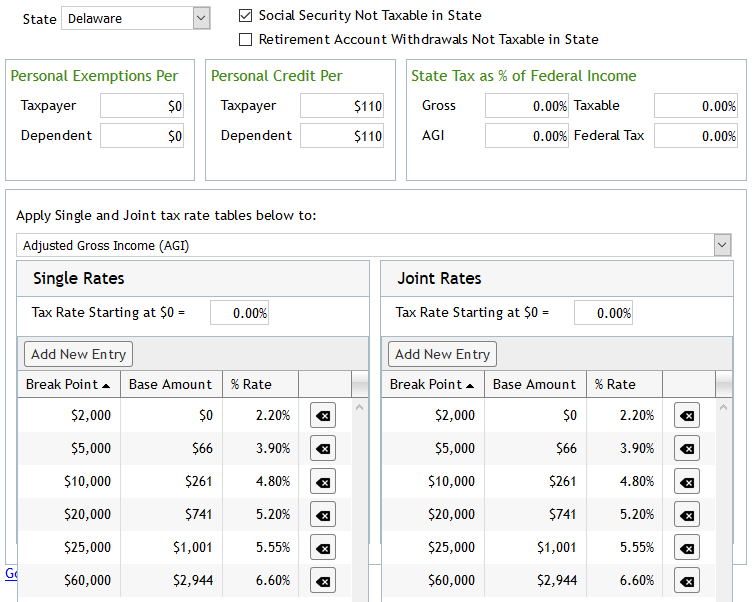

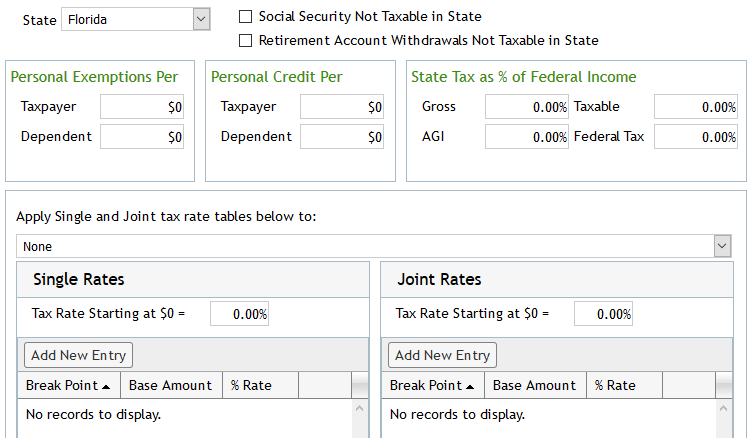

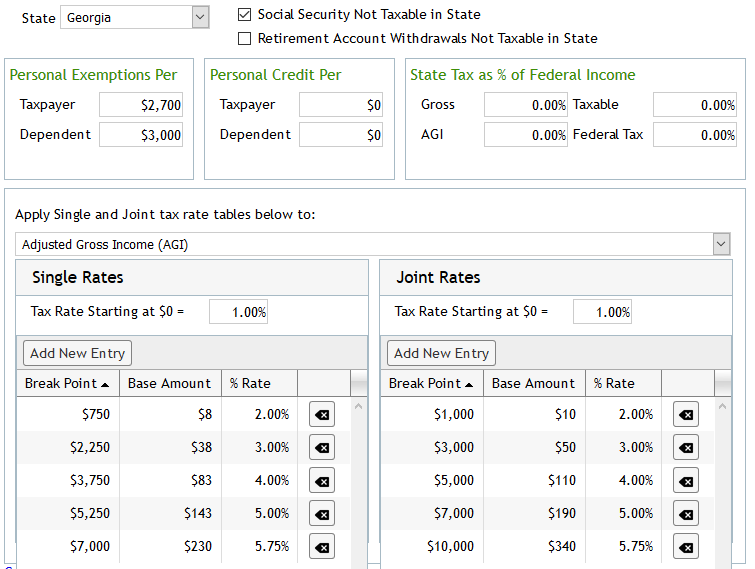

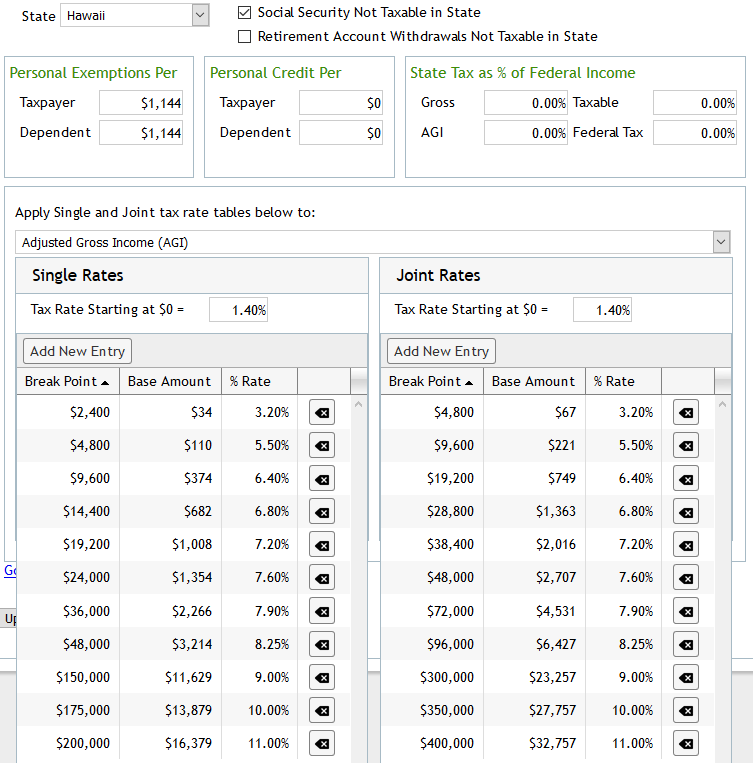

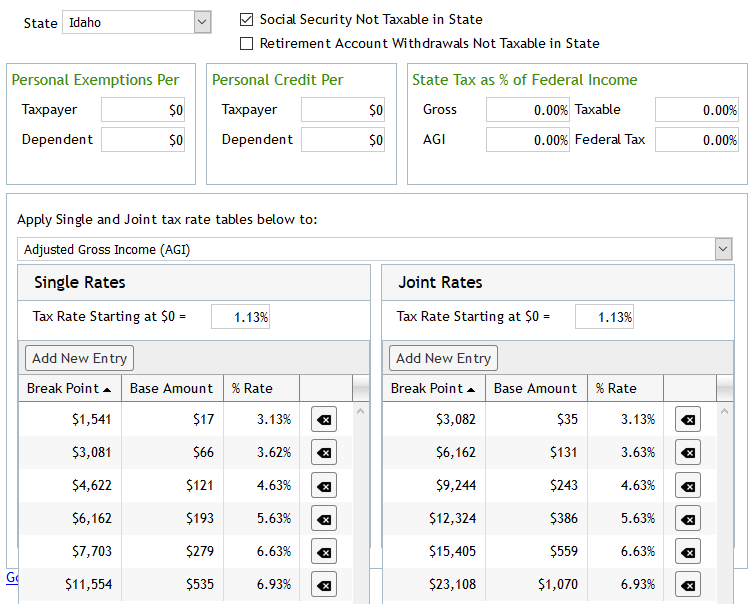

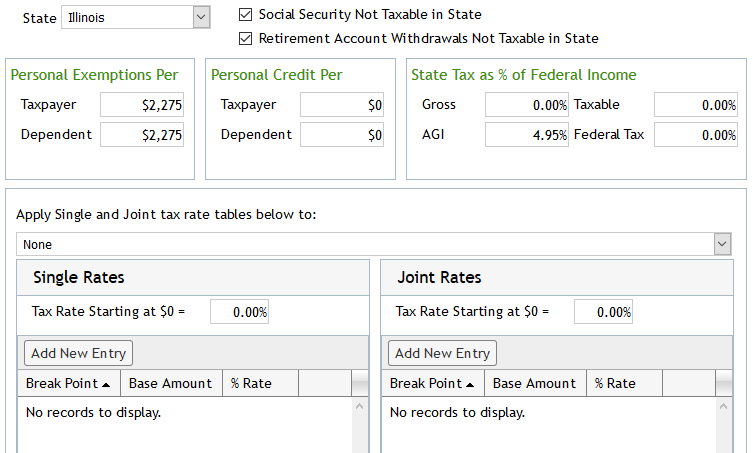

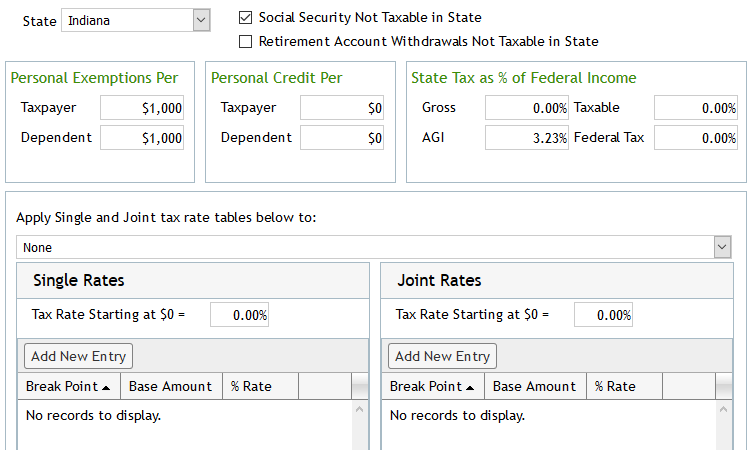

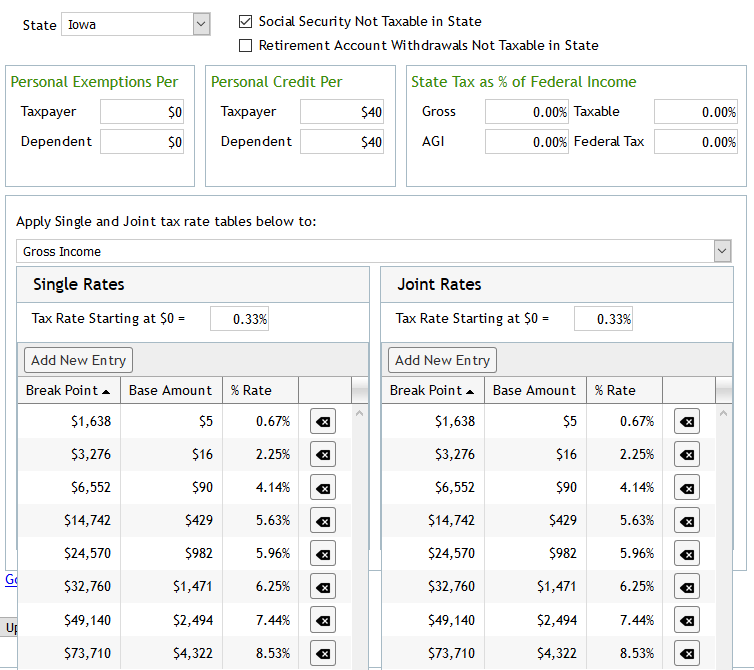

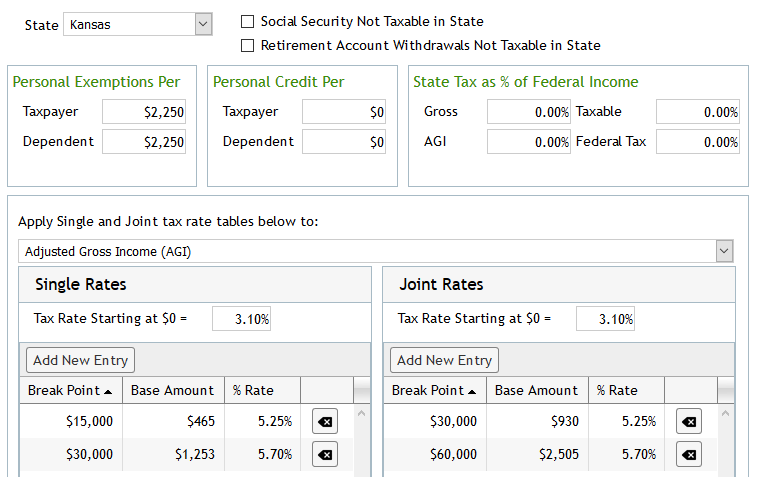

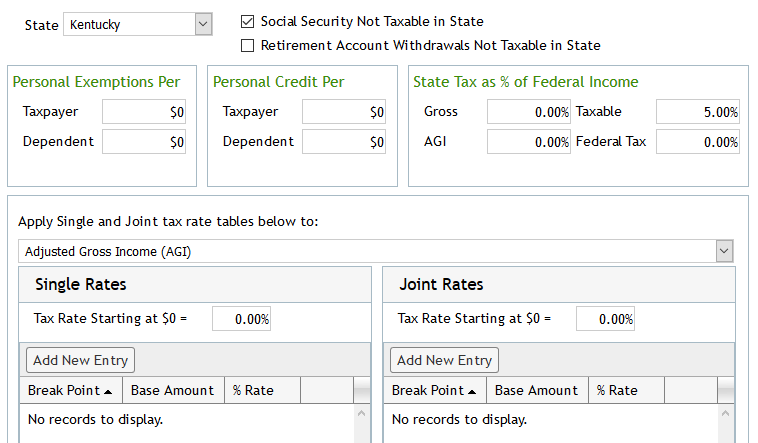

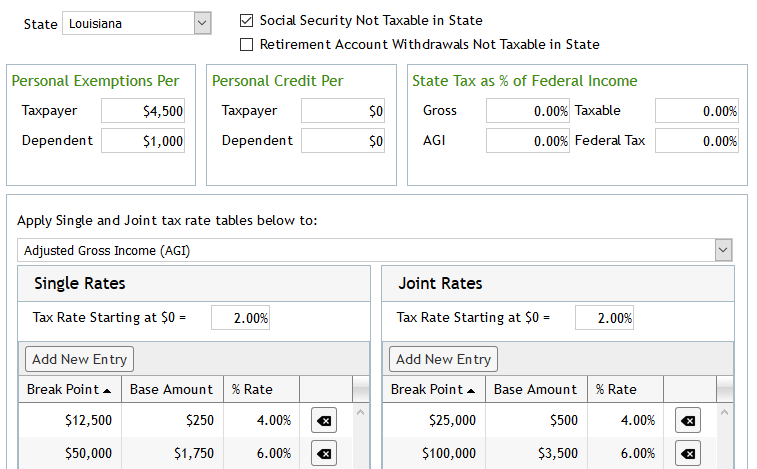

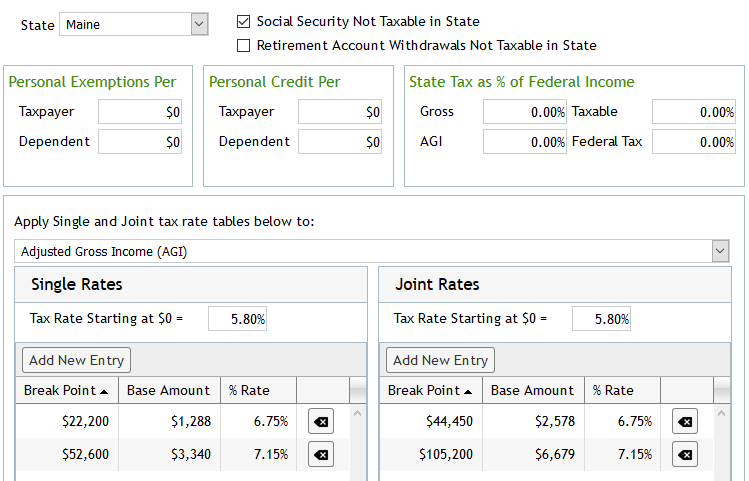

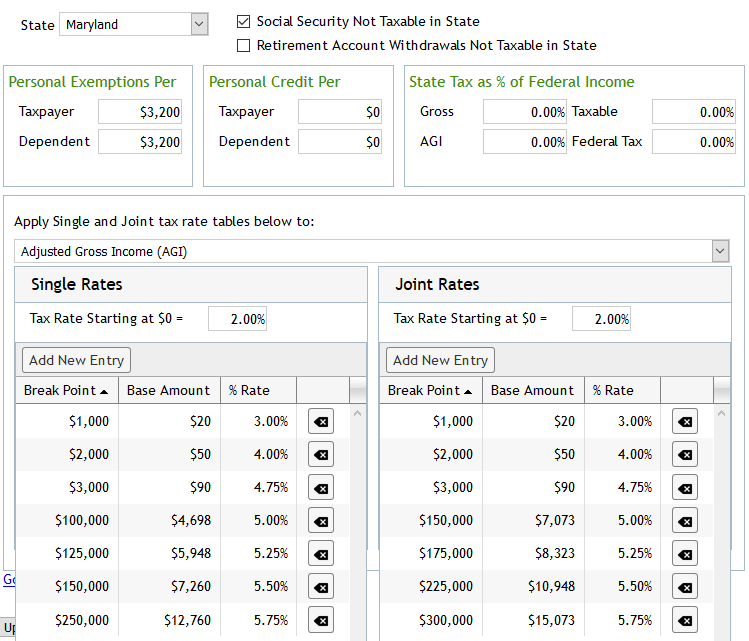

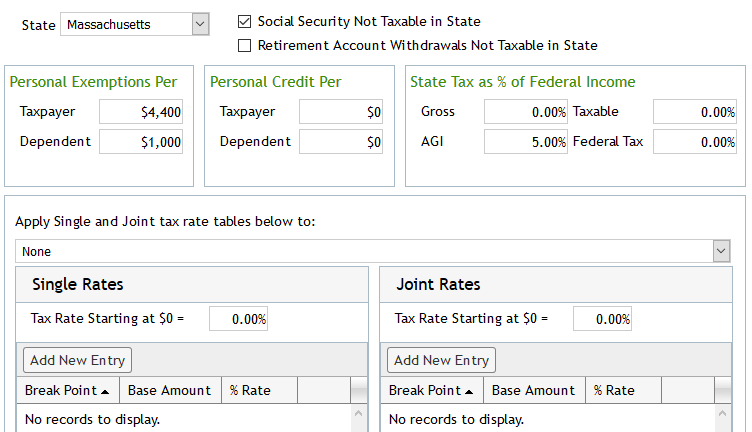

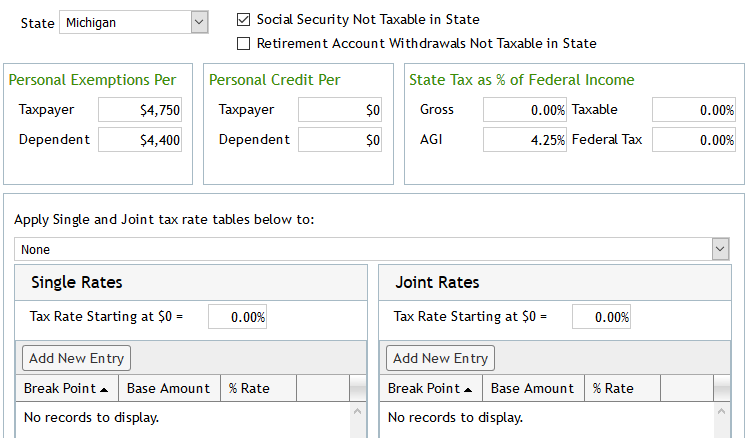

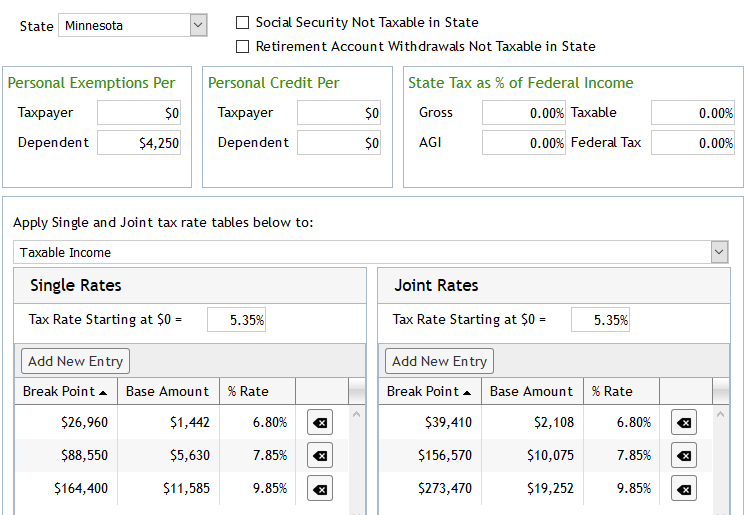

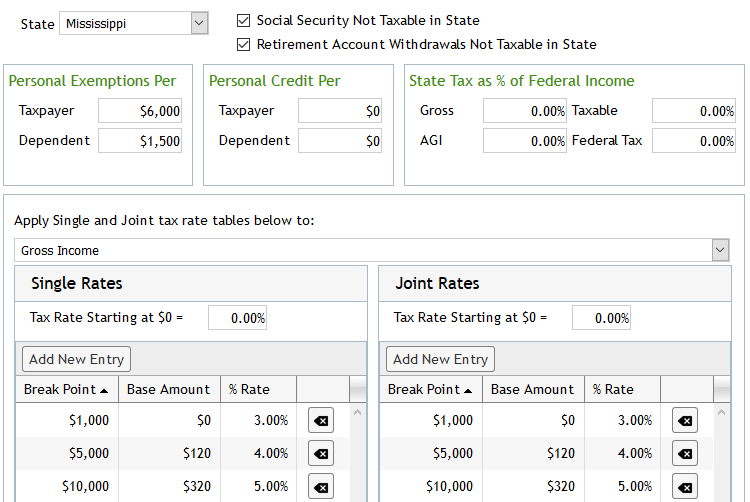

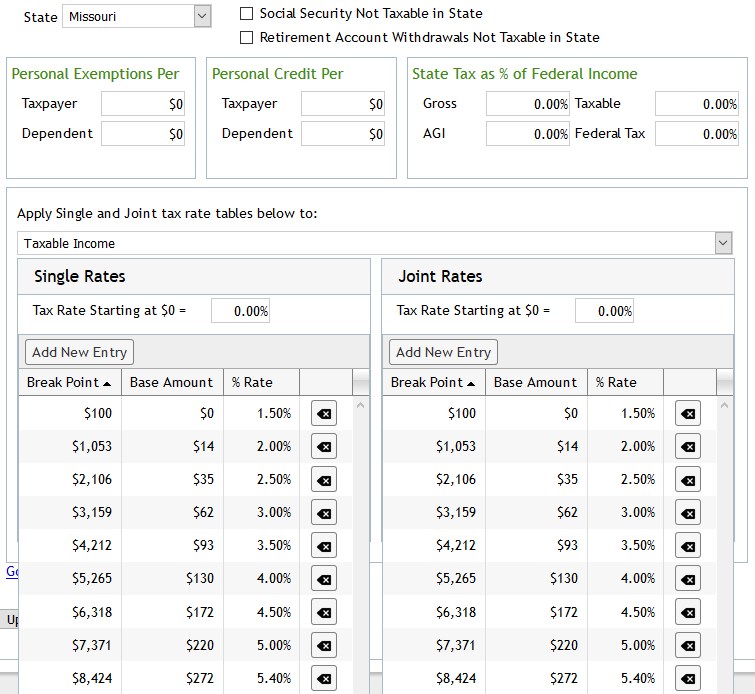

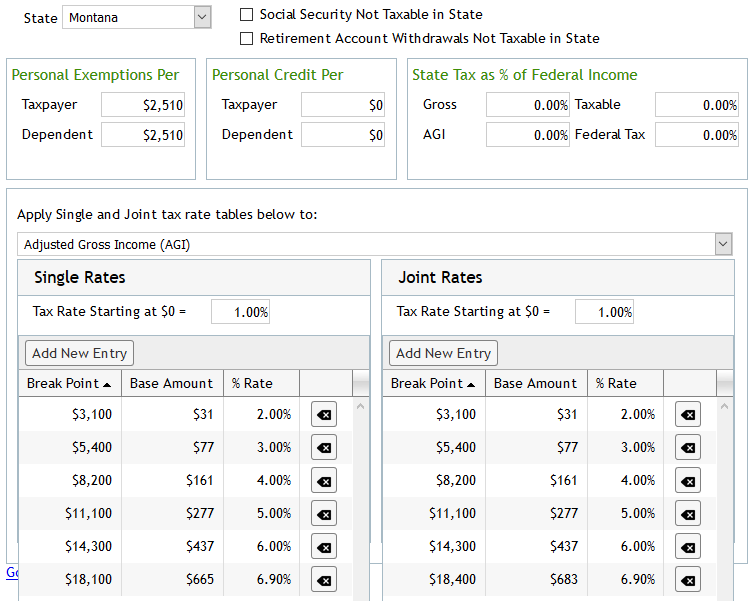

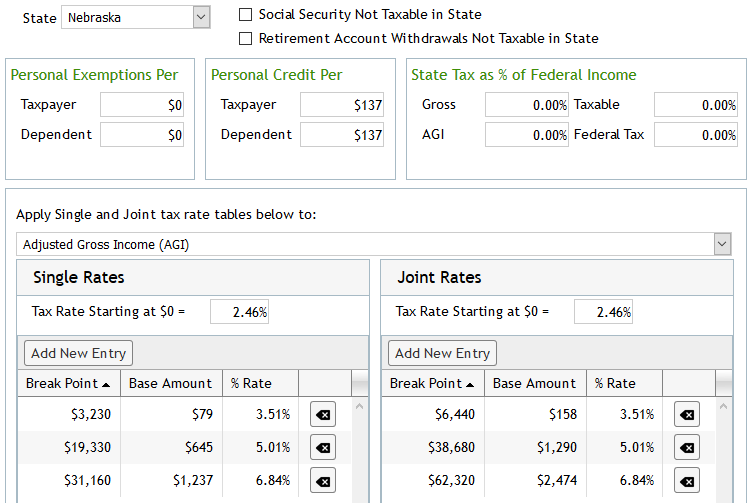

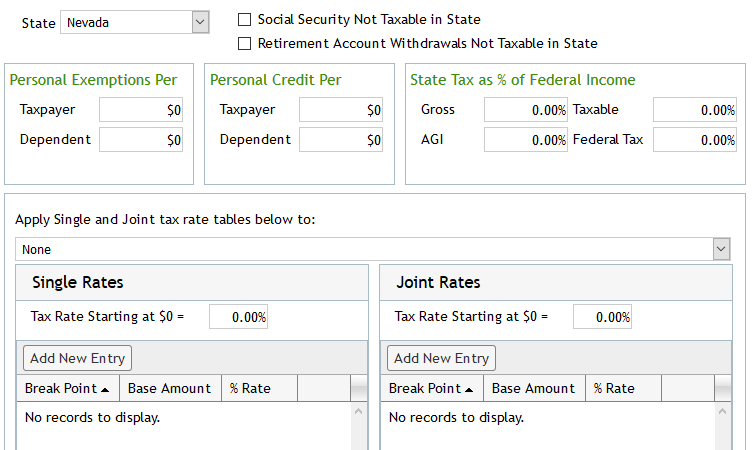

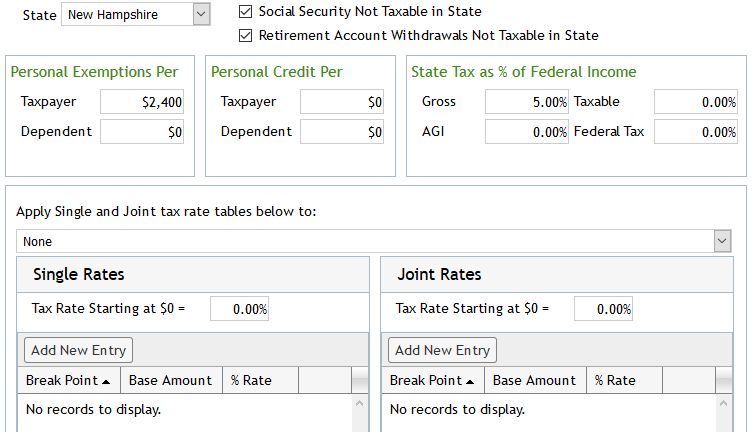

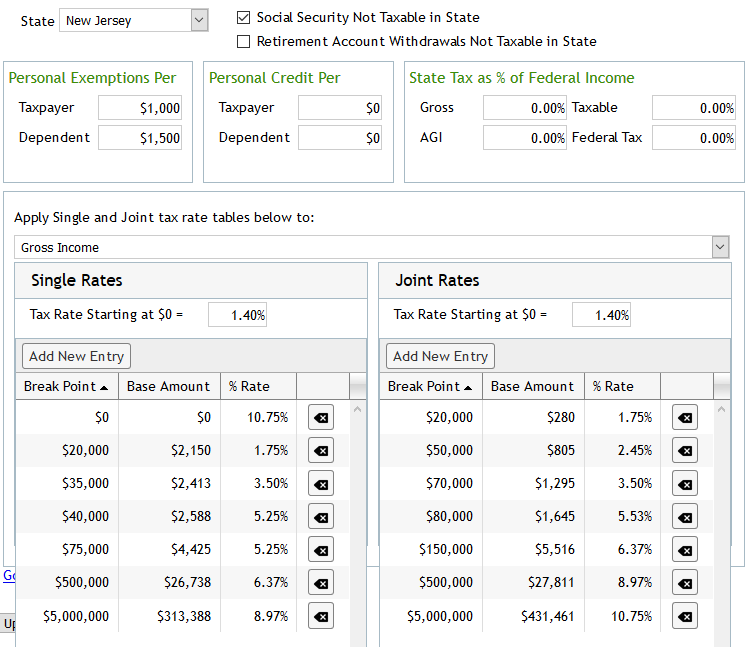

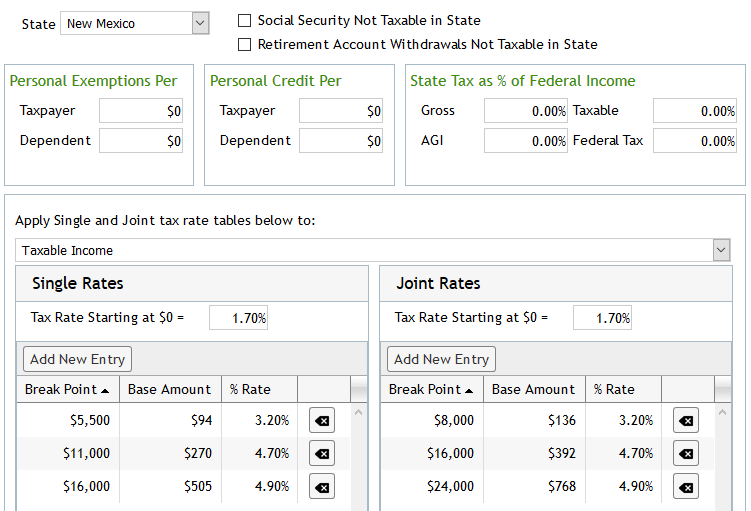

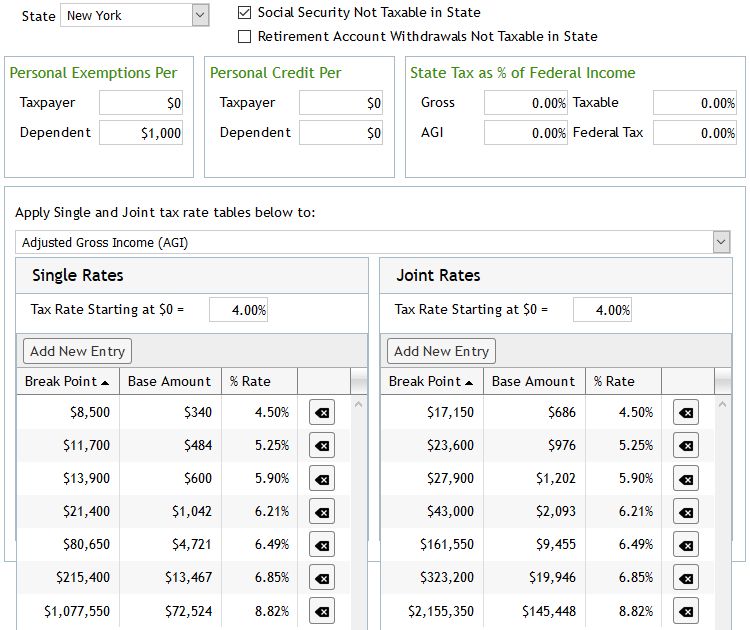

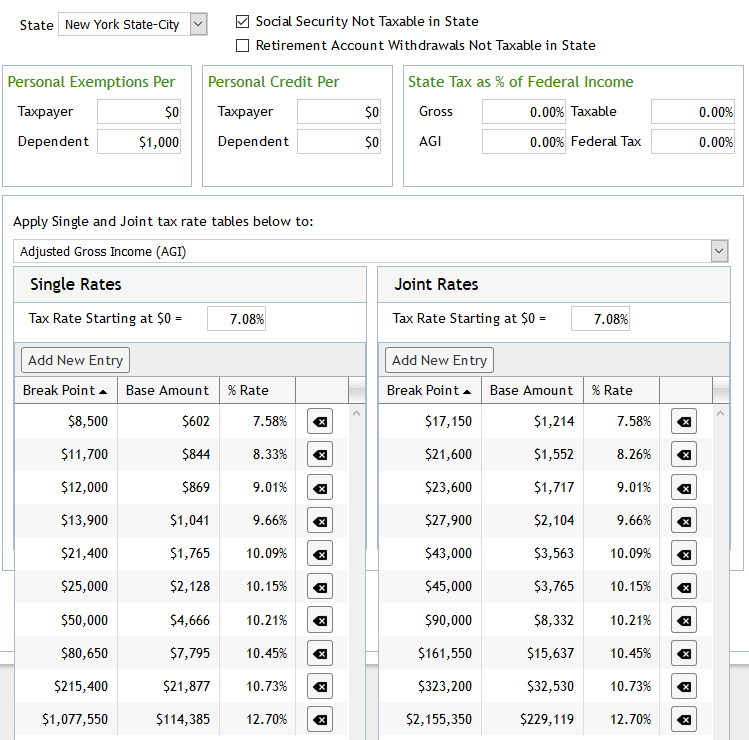

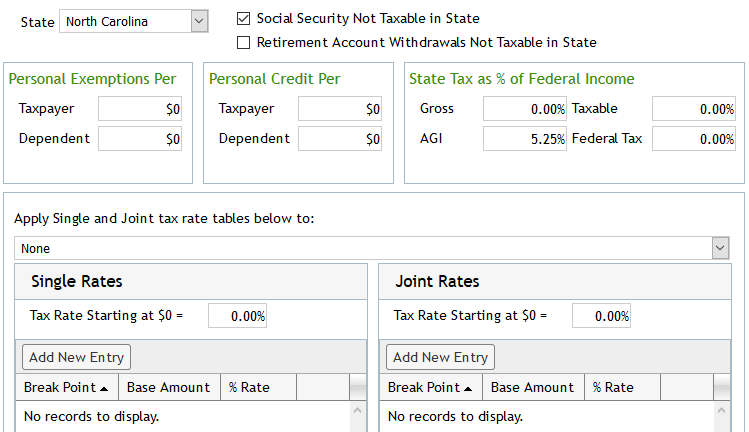

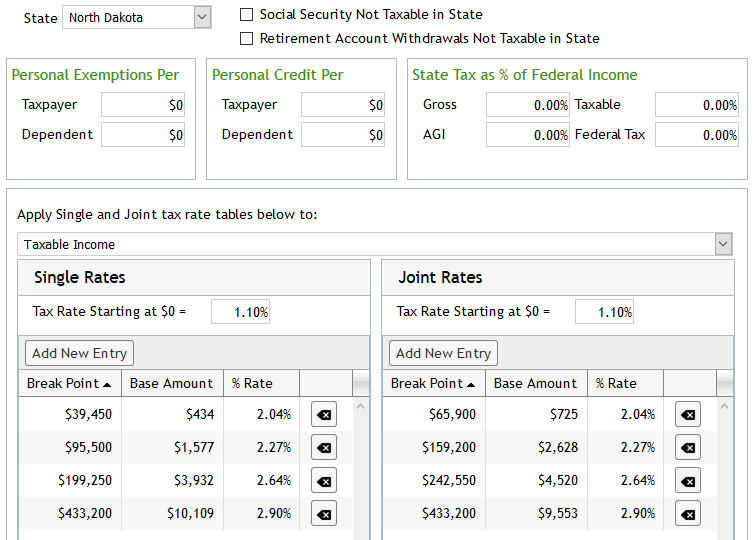

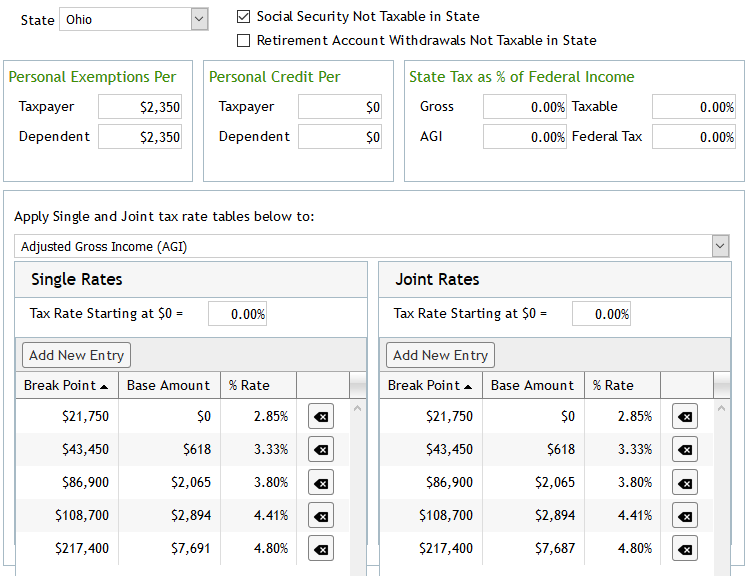

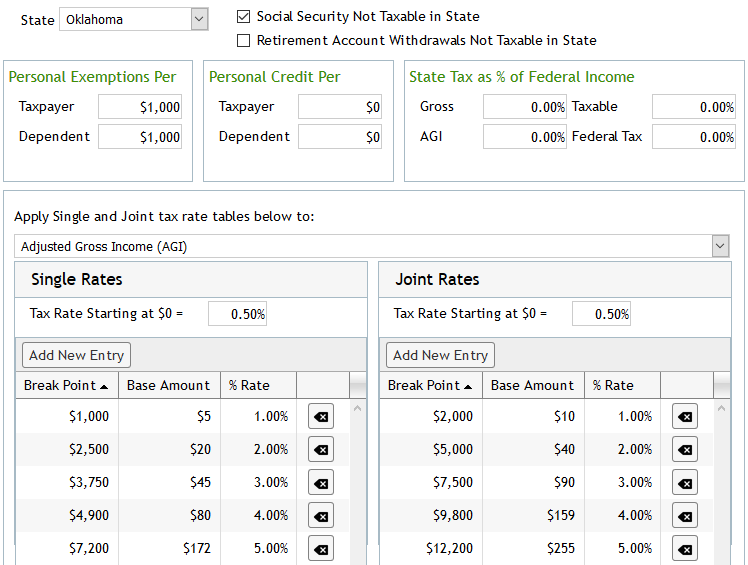

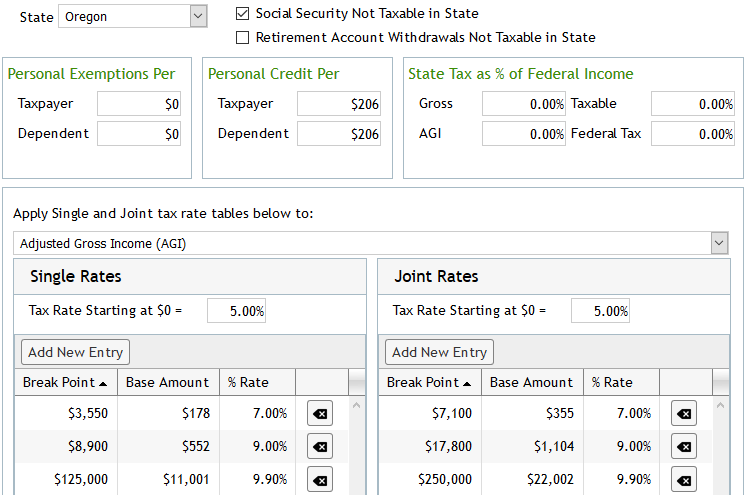

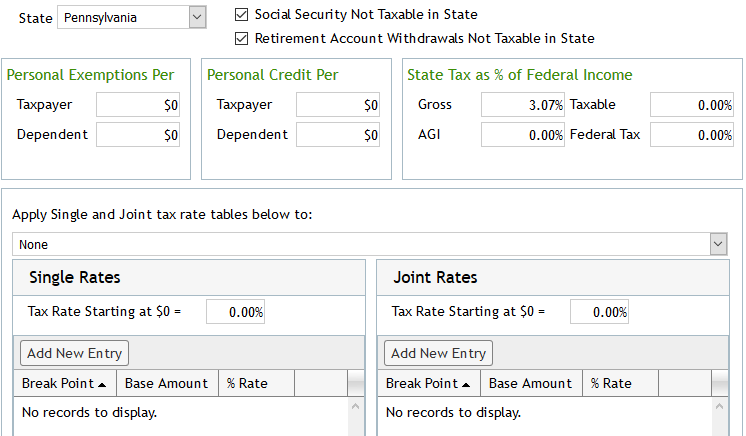

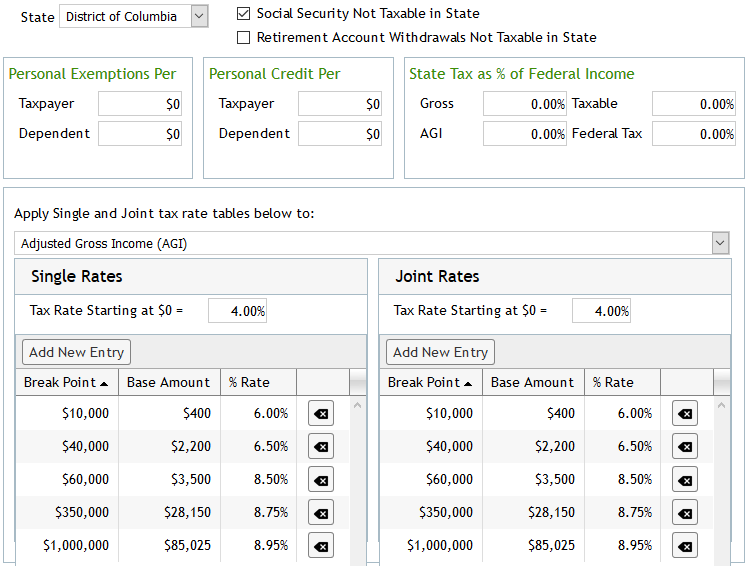

Information for individual states can also be modified in the state tax settings by using the various fields available. The information used for individual states (including New York City and Washington DC) is provided below.

Online users can also enroll for automatic state tax updates by checking the box titled “Allow Money Tree to Update State Tax.” For 2020 automatic updates will roll out on July 16.

How Moneytree Looks at State Taxes

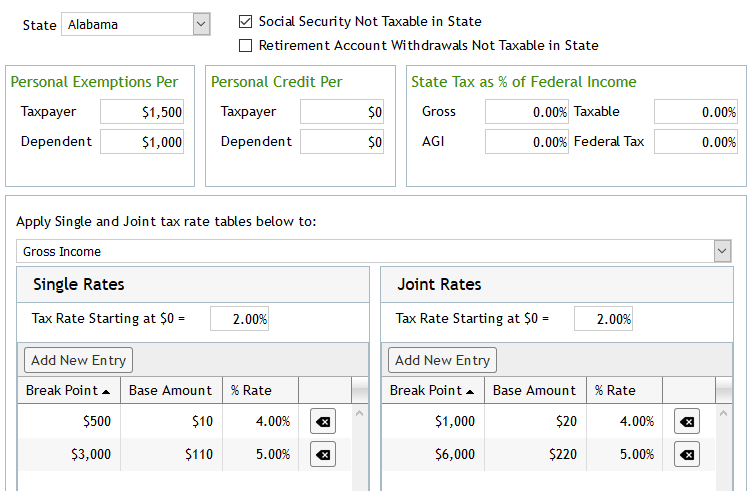

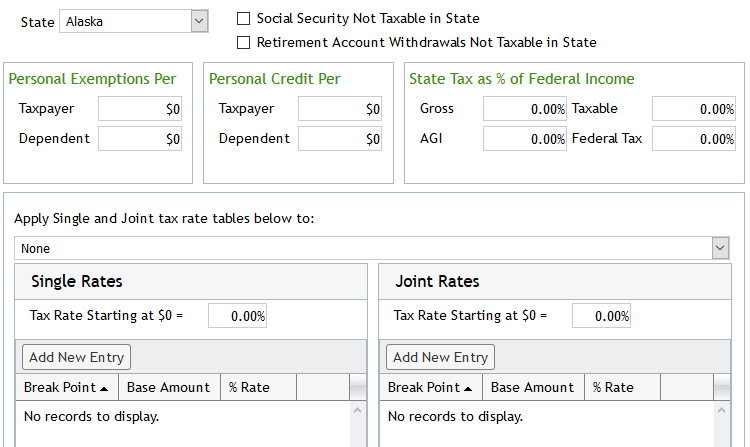

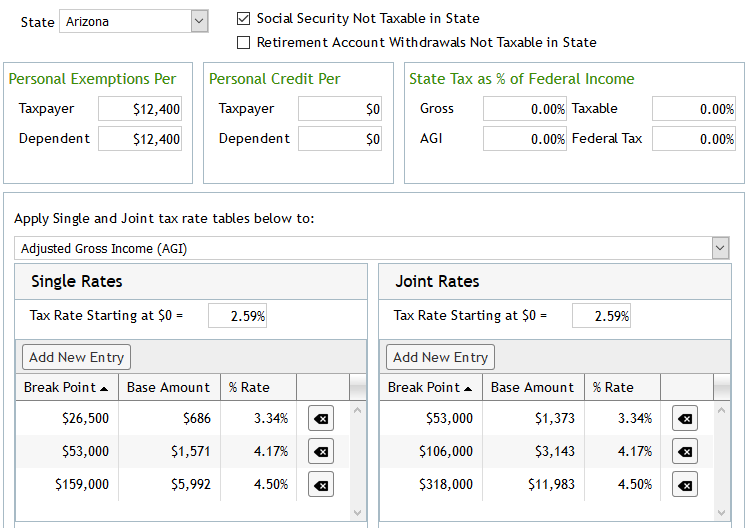

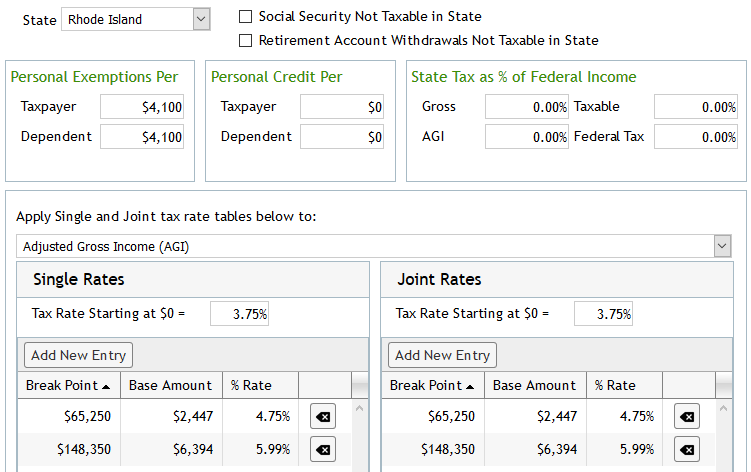

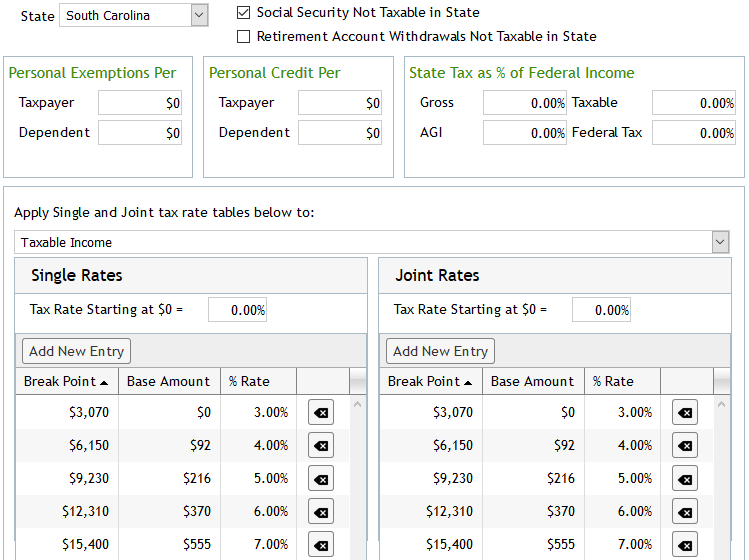

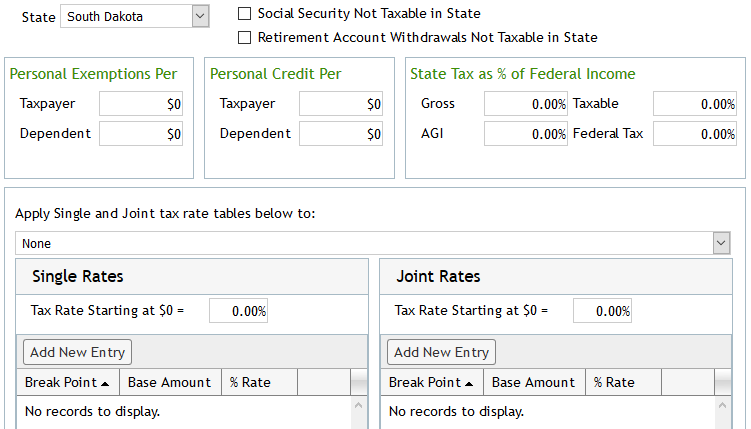

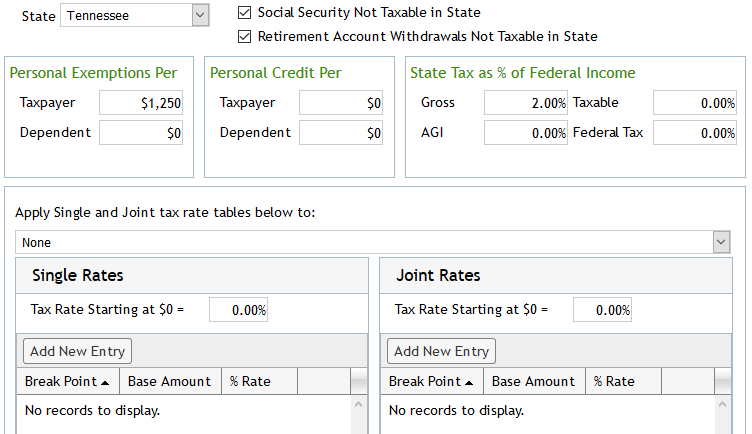

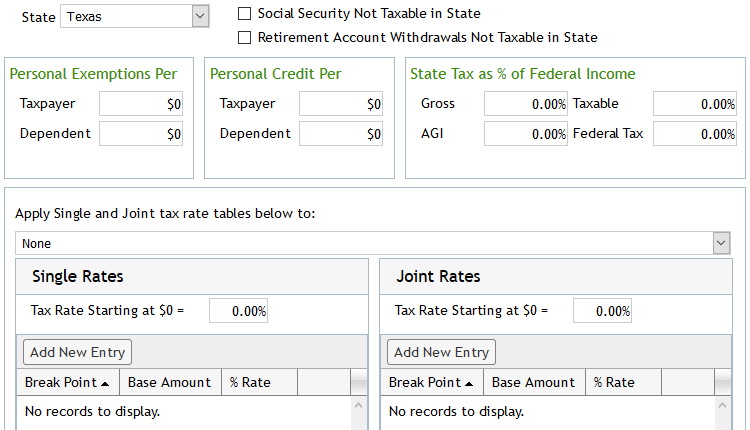

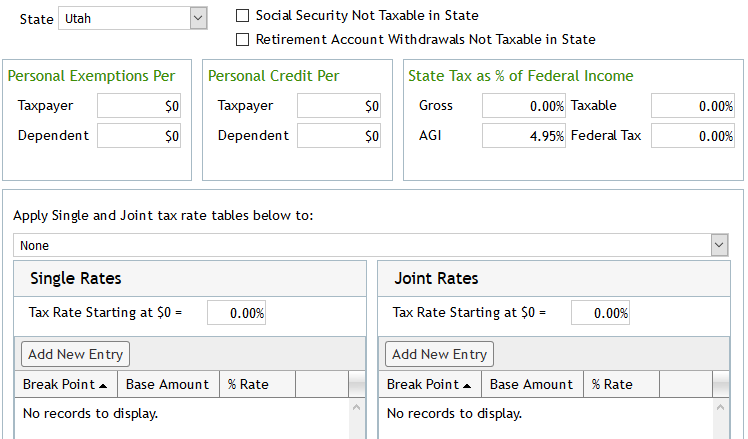

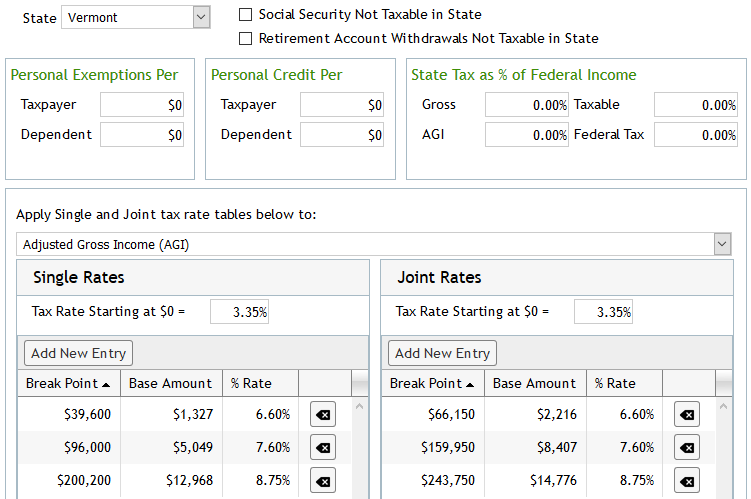

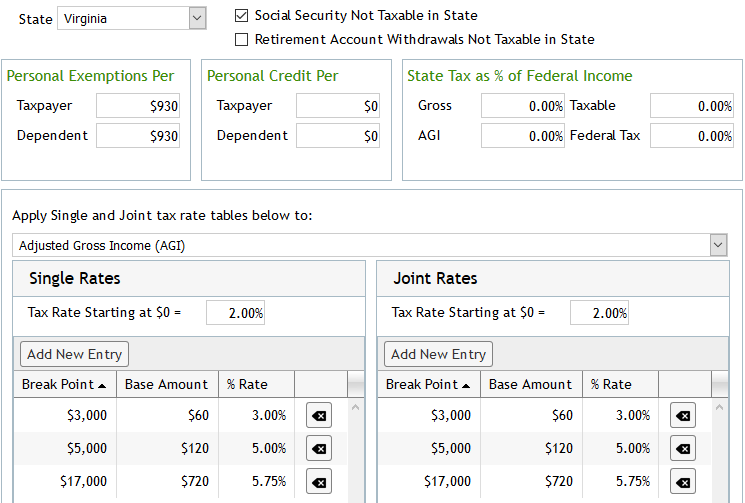

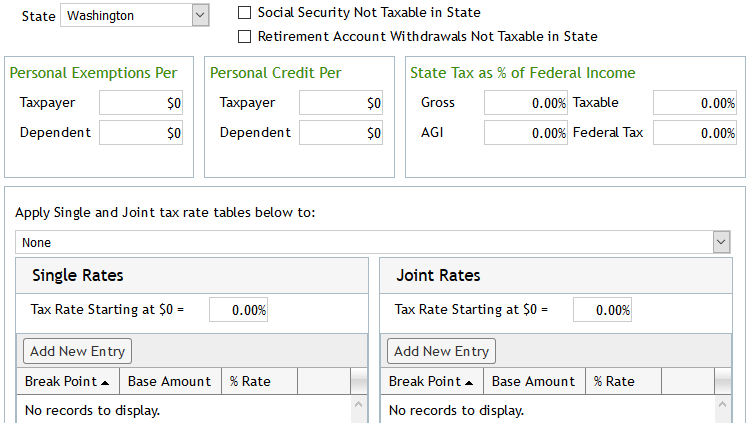

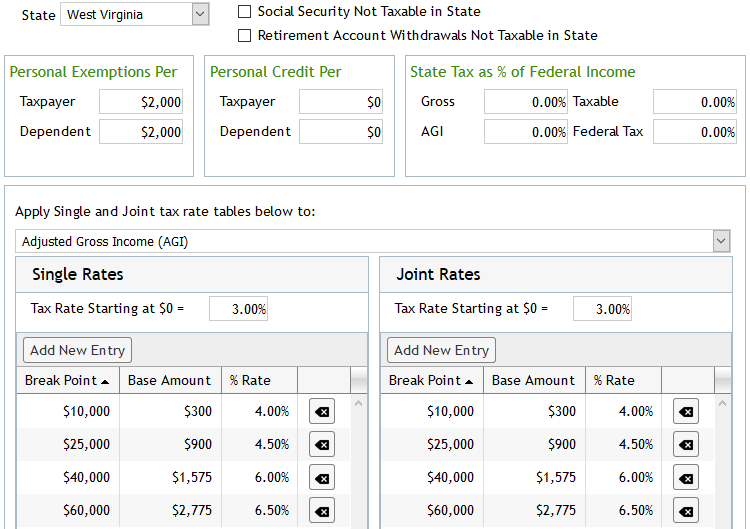

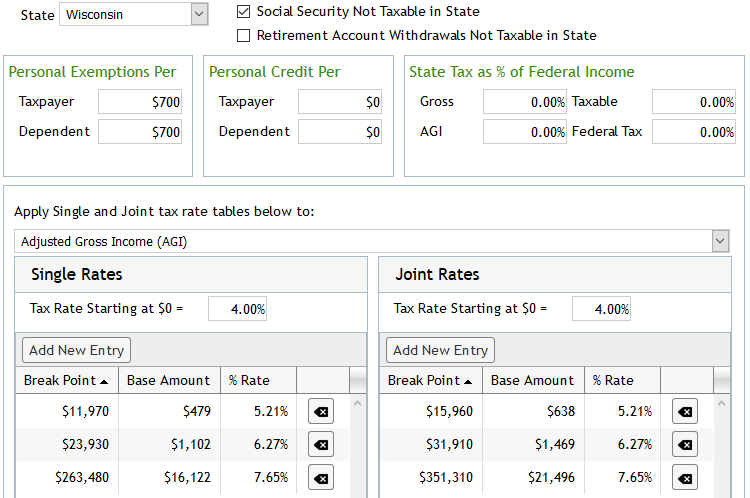

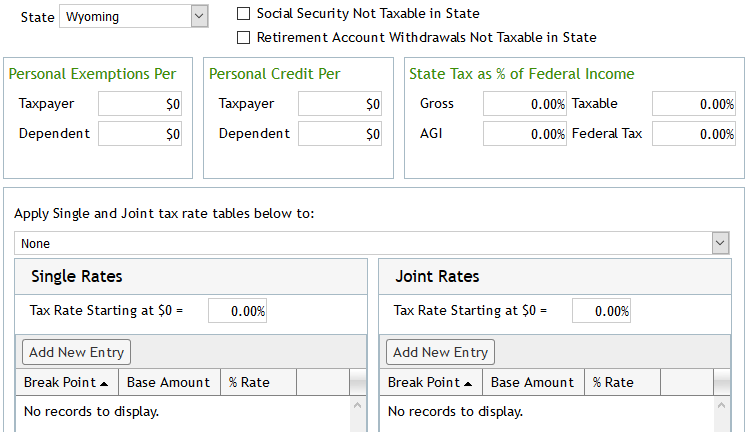

Screenshots of the state tax rates as entered in TOTAL Online are available below. The tax settings have been entered in a conservative manner.

In many states there are standard deductions near or equal to the amount of the federal deductions, but do not allow all federal itemized deduction items. For those states, the state tax rates are set to apply to AGI, leaning towards conservative assumptions. Choosing to apply state tax rates to federal taxable income would include all federally allowed itemized deductions (or federal standard deduction if not itemizing) for the state tax calculations.

The option to exclude retirement account withdrawals is not selected for any states that offer partial exemptions of retirement income.

For states only taxing interest and dividend income (New Hampshire and Tennessee) the tax rate is applied to all income except of Social Security and Retirement Account Withdrawals given the availability of those options.

Remember, adjustments can be made per plan. An option to exclude pension plans taxes on either the federal or state level is available on Pension plan data. Additional adjustments can be made using Tax Details plan data to adjust the client’s state taxable income or tax amount.

Information Resource:

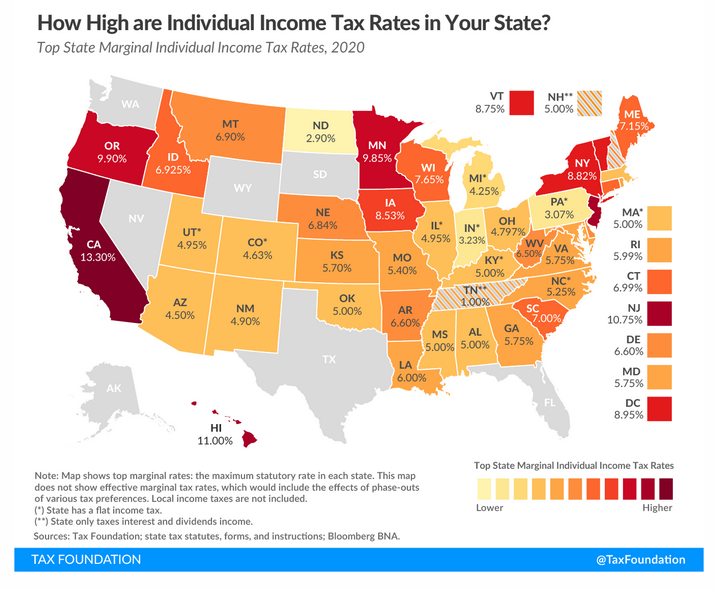

State Individual Income Tax Rates and Brackets for 2020

State Tax Information per State

Jump to State:

AL | AK | AZ | AR | CA | CO | CT | DE | FL | GA | HI | ID | IL | IN | IA | KS | KY | LA | ME | MD | MA | MI | MN | MS | MO | MT | NE | NV | NH | NJ | NM | NY | NYC | NC | ND | OH | OK | OR | PA | RI | SC | SD | TN | TX | UT | VT | VA | WA | WV | WI | WY | D.C.

The Tax Foundation’s article includes notable changes for the year and a graphic displaying the approximate state tax rates across the United States. California has the highest top marginal tax rate of 13.3%.

Alabama

Alaska

Arizona

Arkansas

California

The top rate includes 1% mental health service tax surcharge.