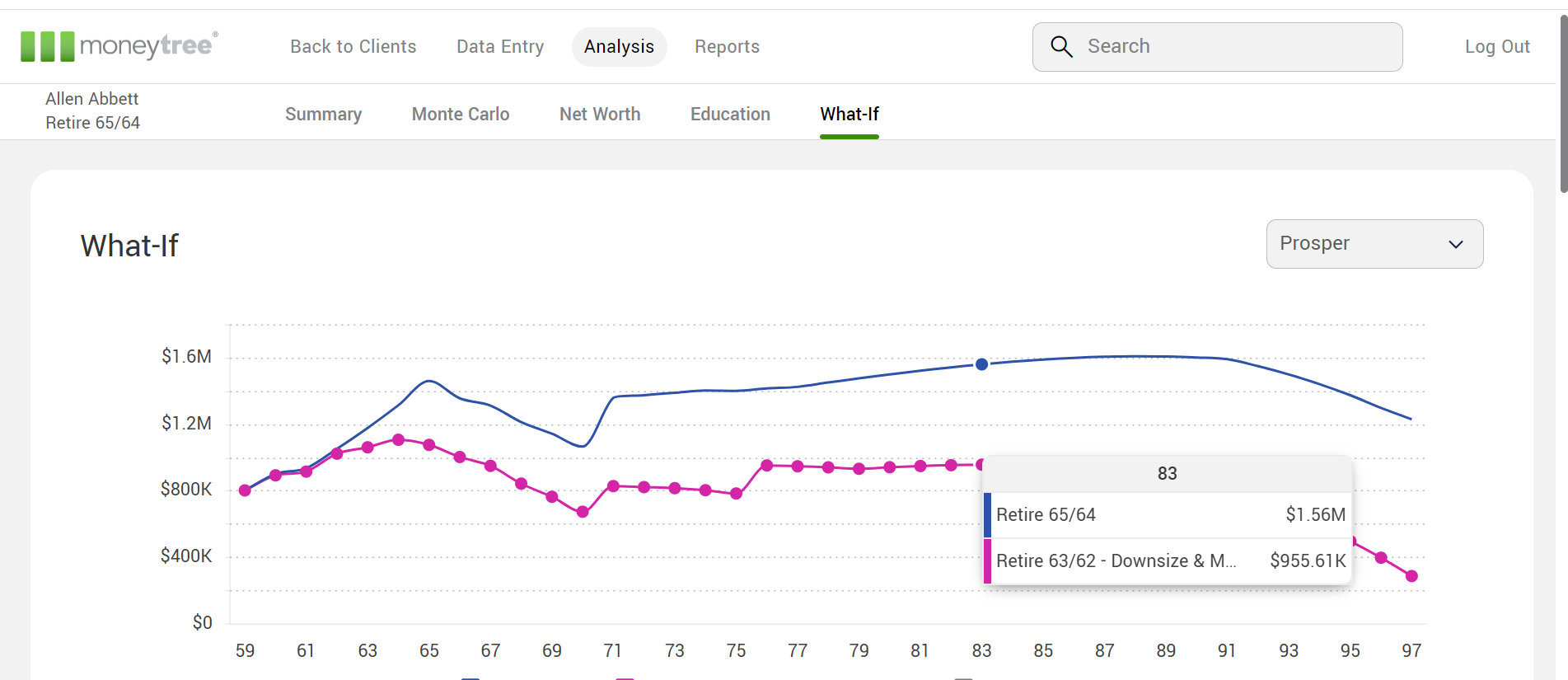

All Moneytree online planning applications include a powerful “What-If” tool that allows you to make on-the-fly adjustments to see how various plan changes could impact your clients’ futures. It will provide the expected projected capital based on fixed-rate assumptions, along with a Monte Carlo simulation based on annually randomized rates of return.

The What-If is not only great for comparing different assumptions and/or strategies, but also can be used to fine tune your financial plan. For example, if the projection appears overly successful and you determine that the spending is too low, you can use the What-If to adjust personal expenses until you find your desired spending target. Once found, you can then make the change in the main financial plan or save the What-If scenario.

Tech Tips for the What-If

1) Keep the changes simple. The What-If provides limited output in order to provide quick comparisons. We recommend changing only 1-3 assumptions so the changes can be identified and communicated easily. For more complicated comparisons, we recommend making a copy of the scenario, so you have access to the full analysis.

2) Complete the plan before saving a What-If. The What-If will retain all data from the point it was saved. Any changes made to the main plan will not be applied to saved What-If scenarios. Waiting until the plan is complete before saving a What-If ensures that there will be no unexpected differences.

3) Reset your saved What-If scenarios if you make changes to the main plan. If you do happen to make changes after saving a What-If, you can reset the What-If so that all the data matches the main scenario. Keeping the changes simple will also make it easy to reapply any alterations that were made previously.

4) The What-If is still useful for uncompleted plans. Though we recommend that you do not save What-If scenarios for incomplete plans, the What-If can still be powerful for them. Have some assumptions or strategies that you want to test before providing a detailed analysis? You can use the What-If to test those, then make the changes in the main plan. The What-If will give a quick look at whether it is feasible for their retirement. Making the changes in the main plan will allow those changes to be seen in Moneytree’s in-depth reports.

5) Create two What-If scenarios side-by-side in Moneytree Plan. When first loading the What-If page of Moneytree Plan, there is a legend below the What-If chart. There will be two colored squares, with a third faded on the right. If you click on the faded legend item, a new column will appear. This will allow you to make changes to two What-If scenarios concurrently and compare the results of each to the main scenario. (This is not an option in Moneytree Advise.)