State tax updates for 2021 are now live in Moneytree Plan. Users can enable or disable these automatic updates in the State Tax section of Settings. Users of the desktop application, TOTAL Planning Suite, and those who had the box unchecked can quickly update state tax tables by clicking the button “Reset All State Tax Data.”

How Moneytree Looks at State Taxes

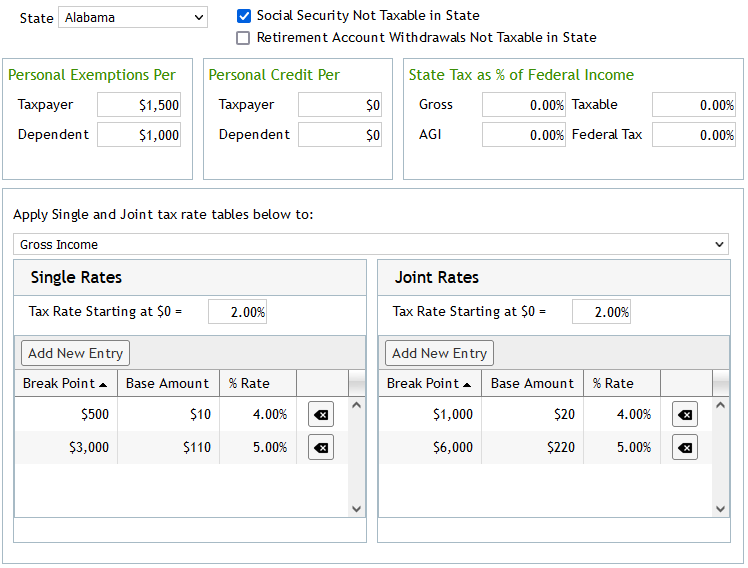

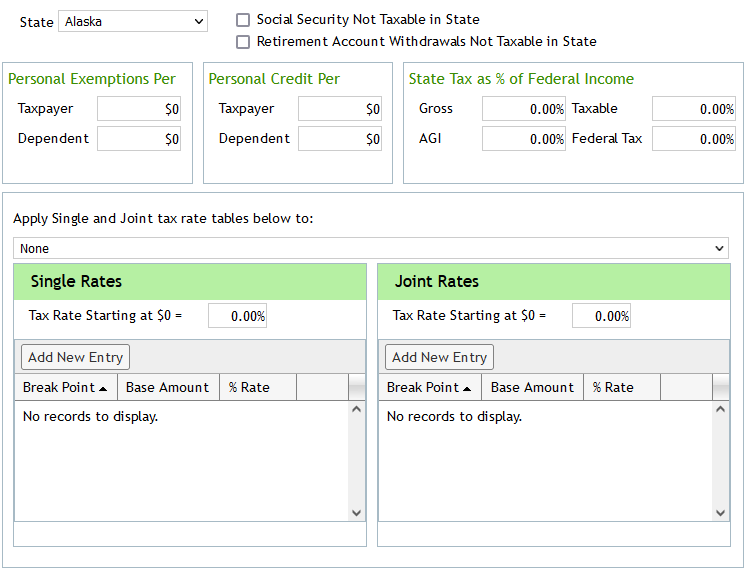

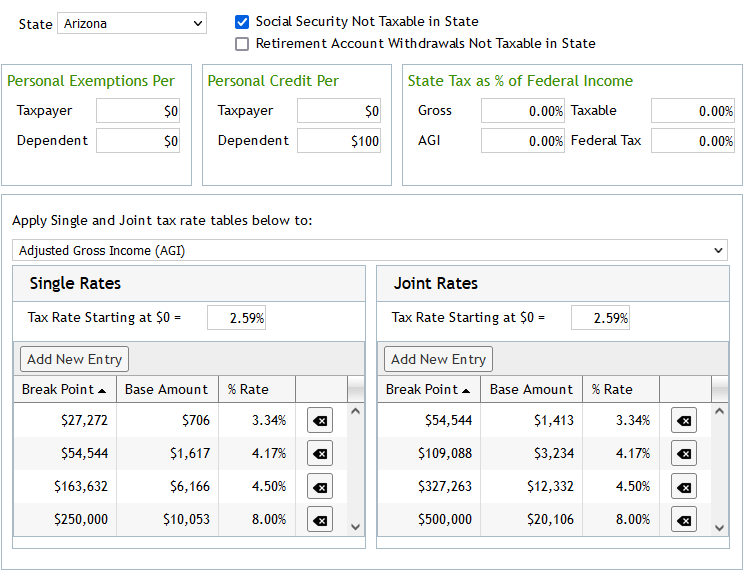

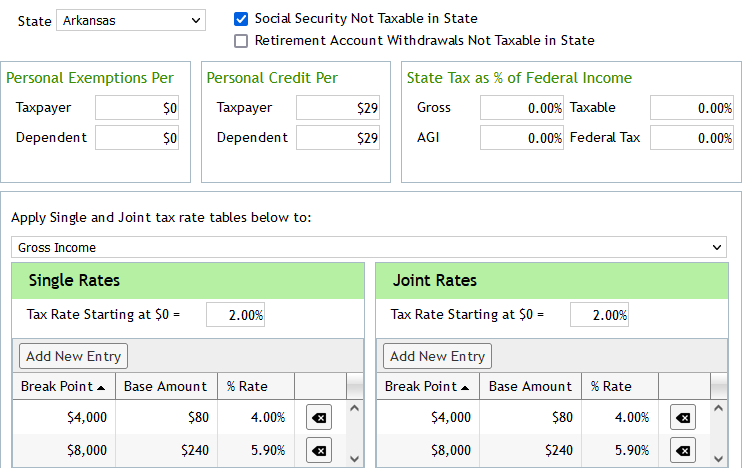

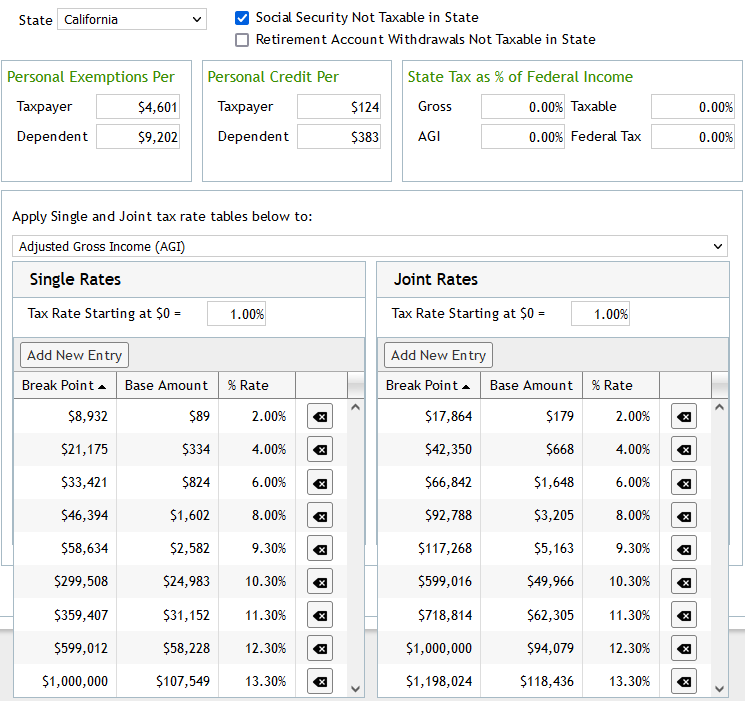

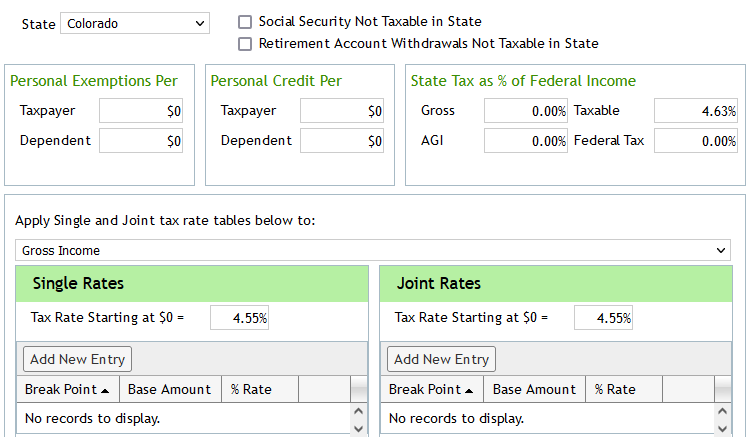

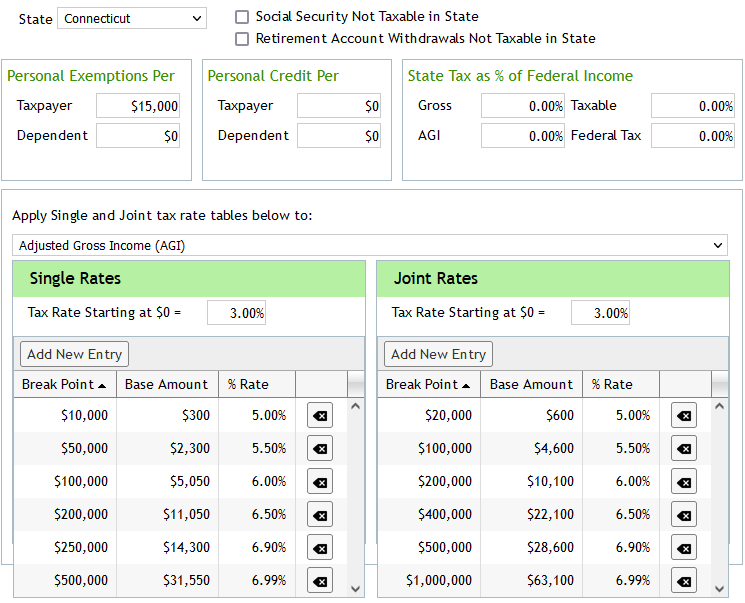

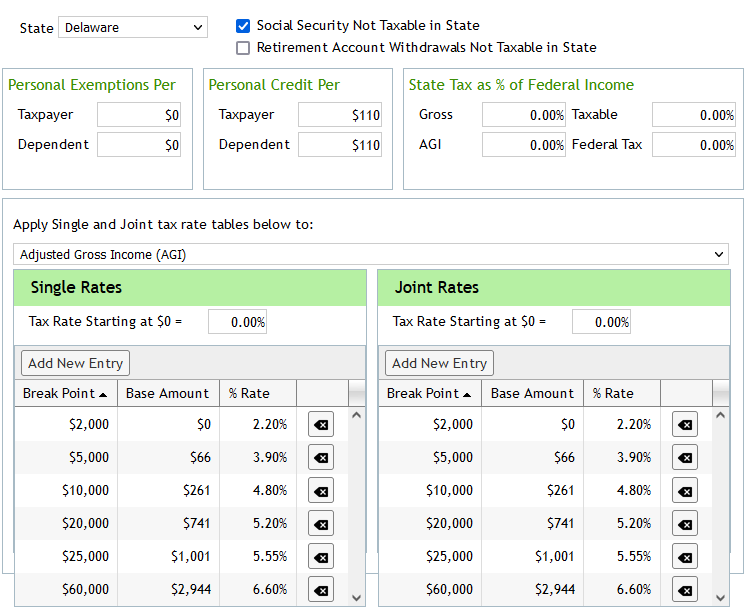

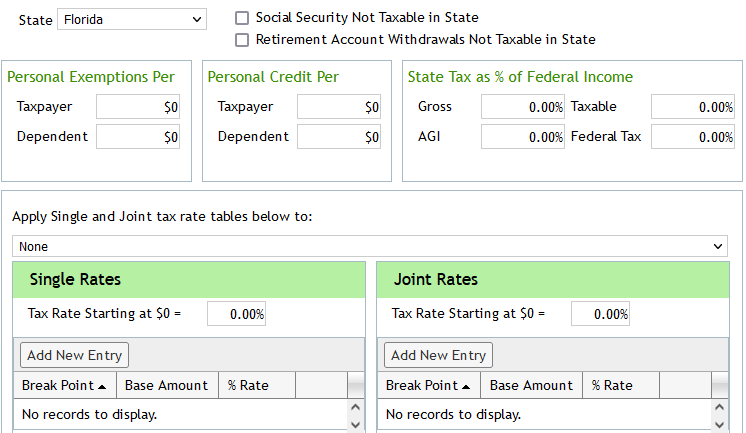

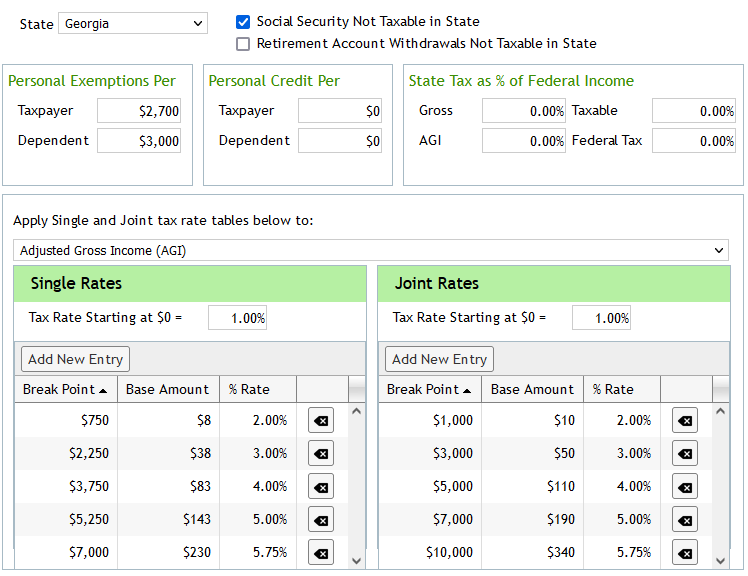

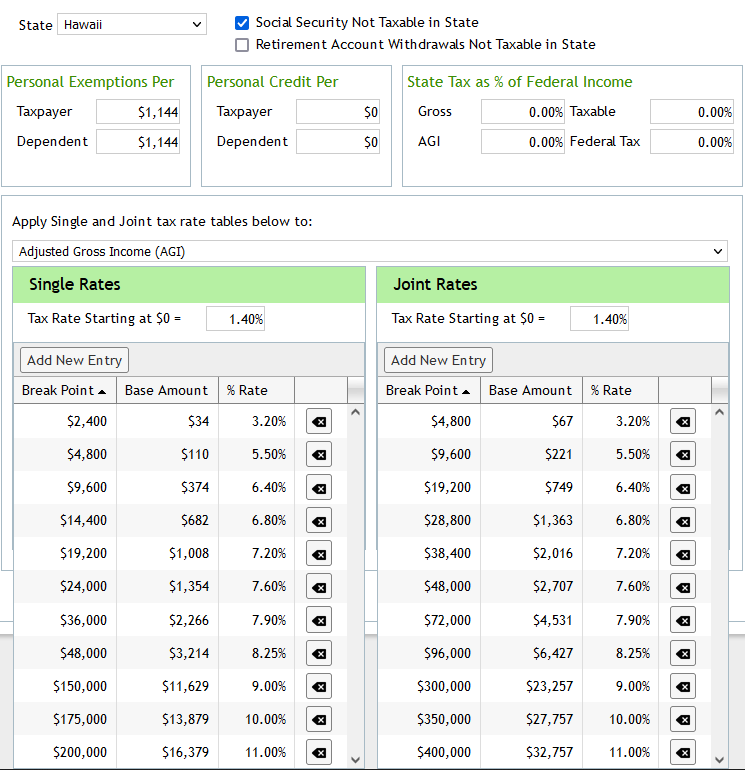

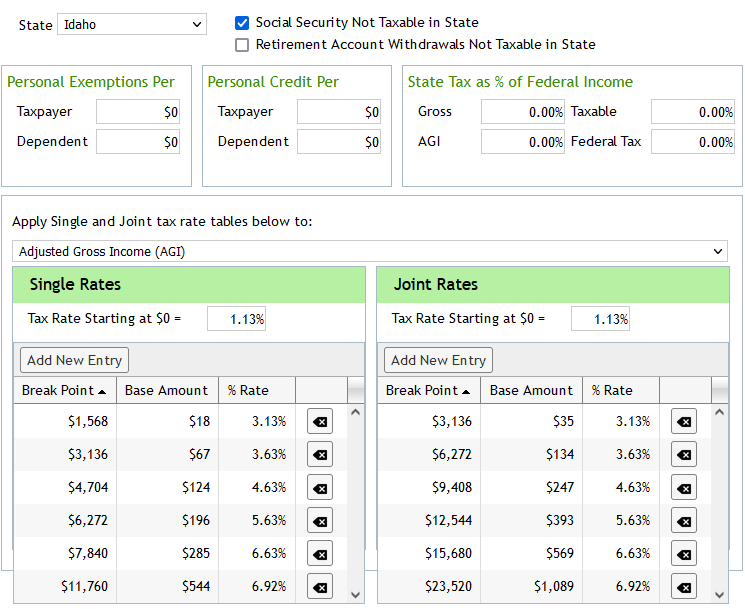

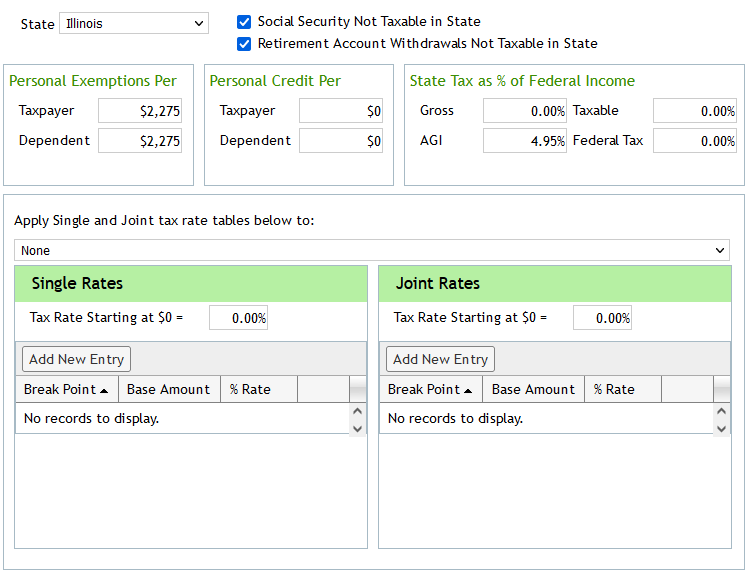

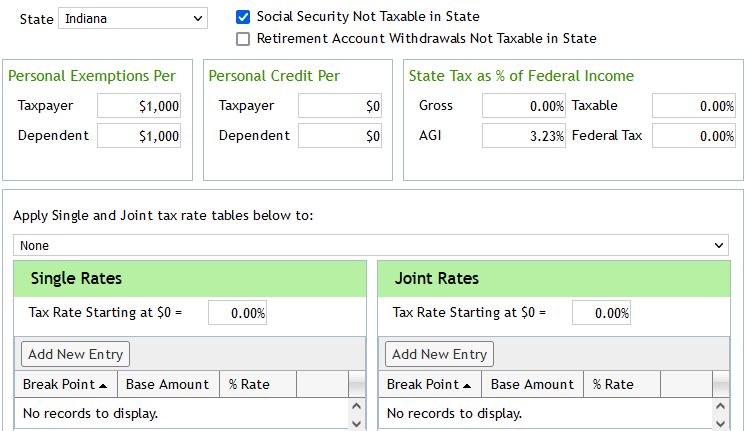

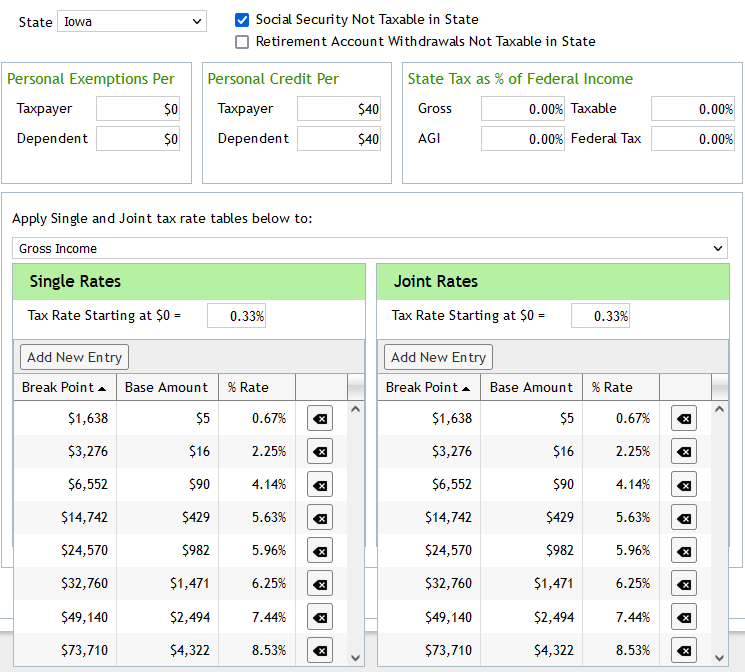

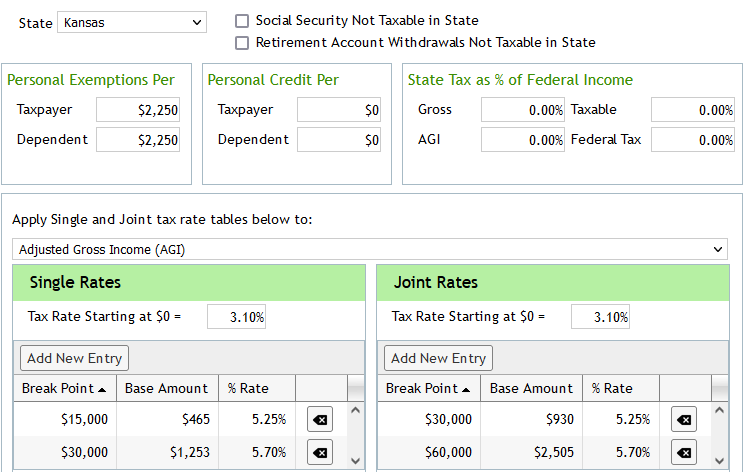

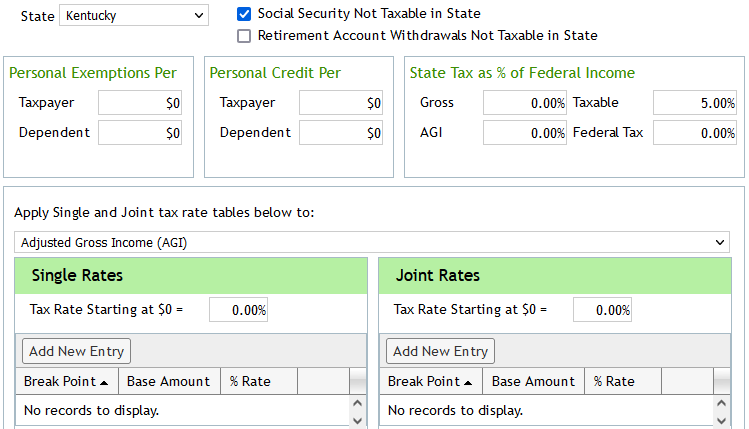

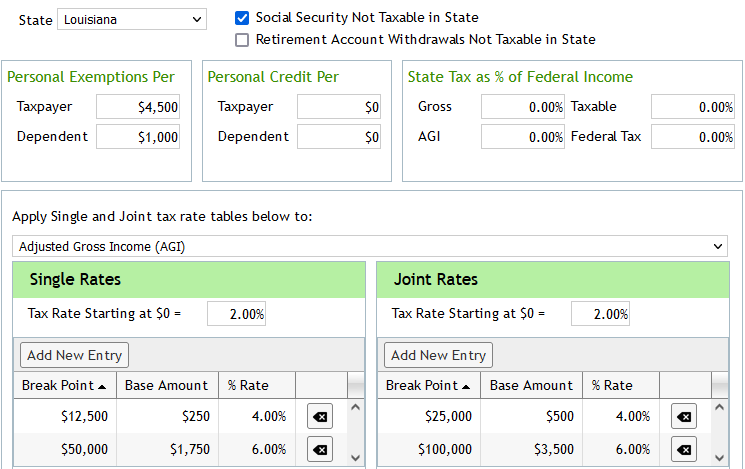

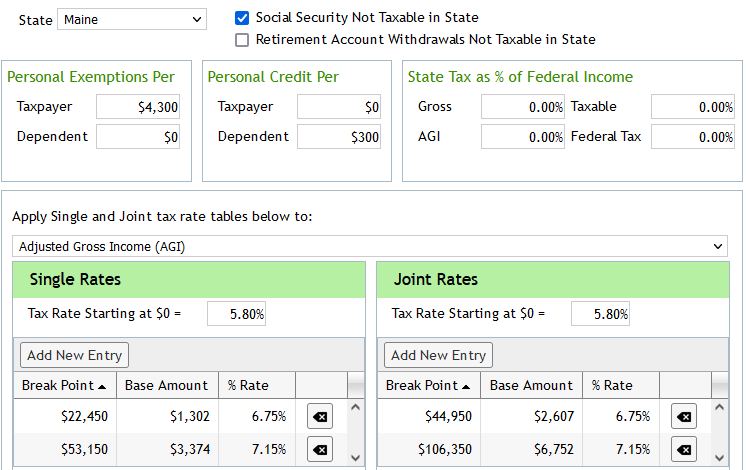

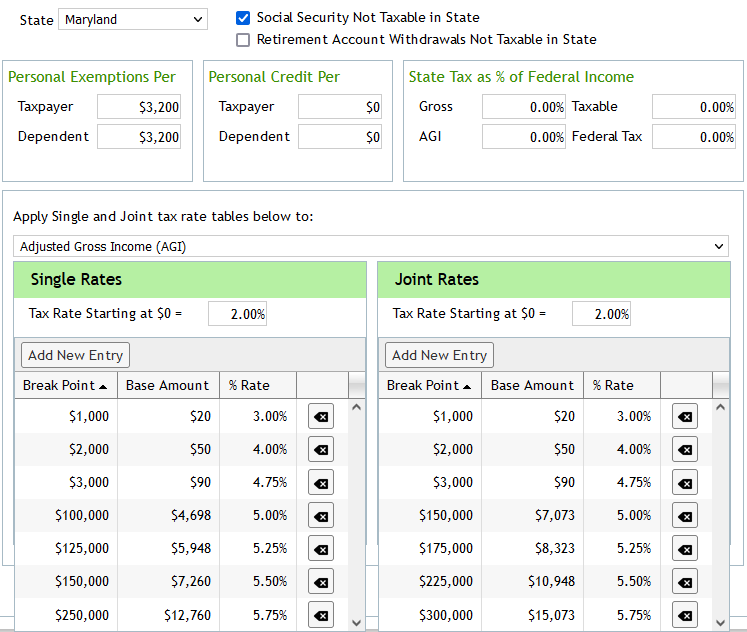

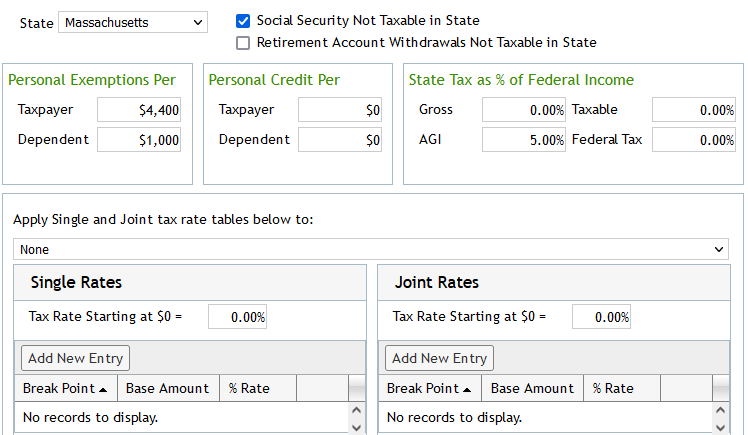

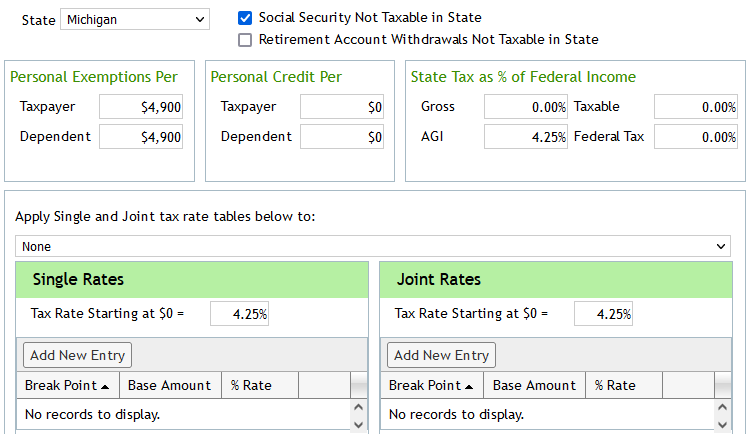

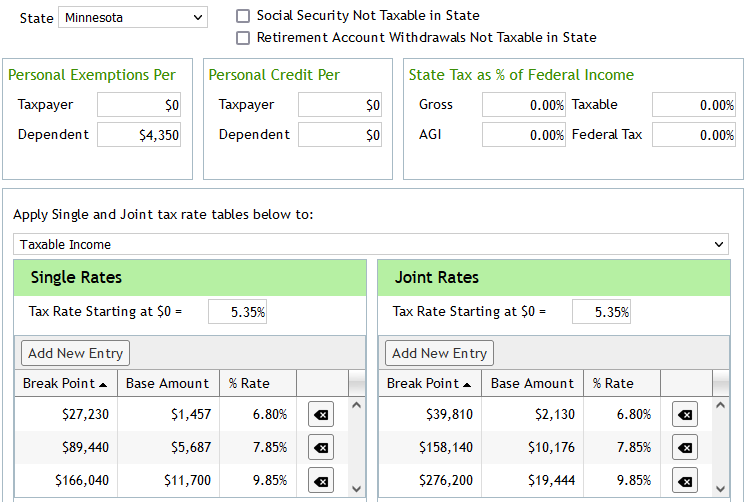

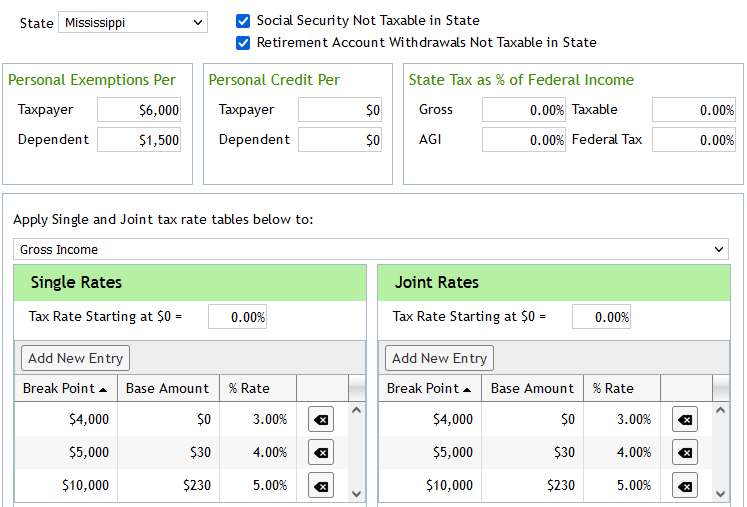

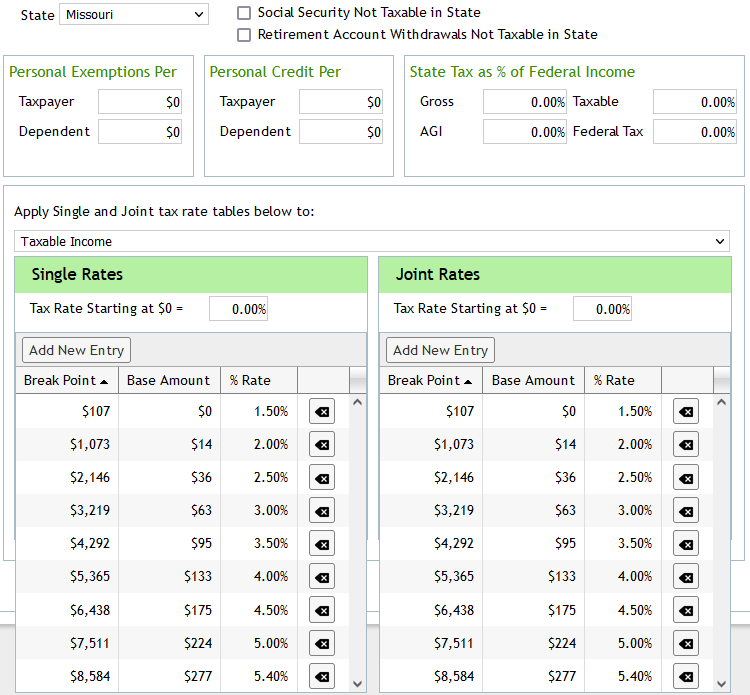

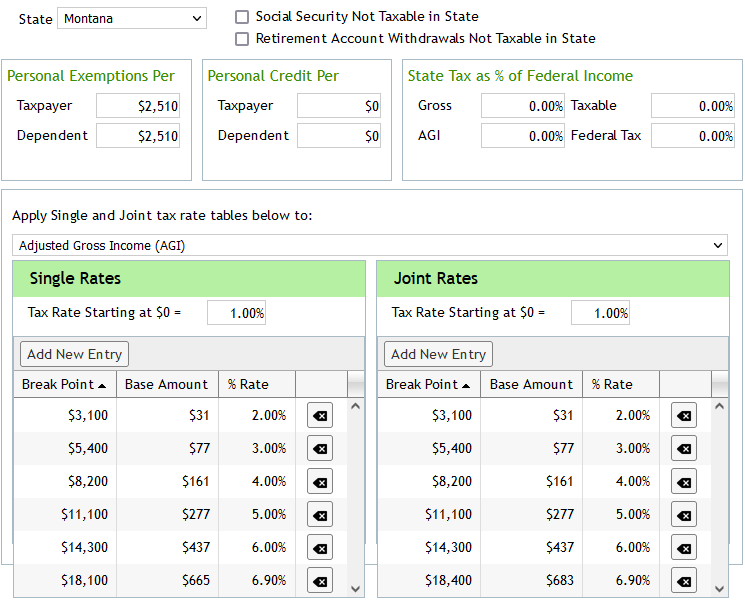

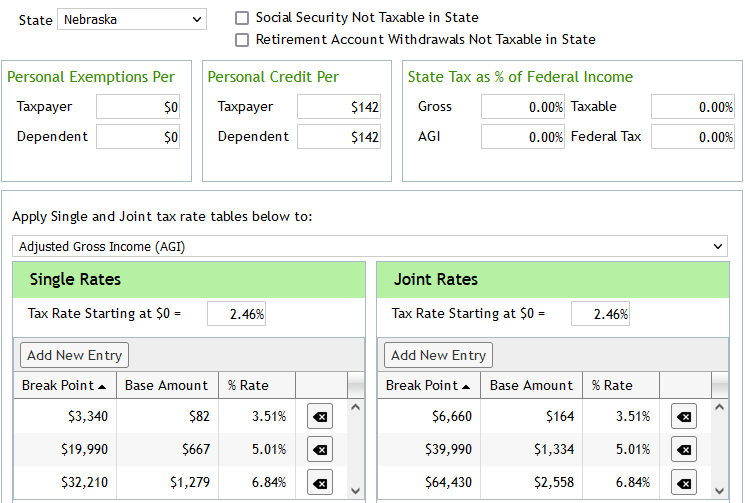

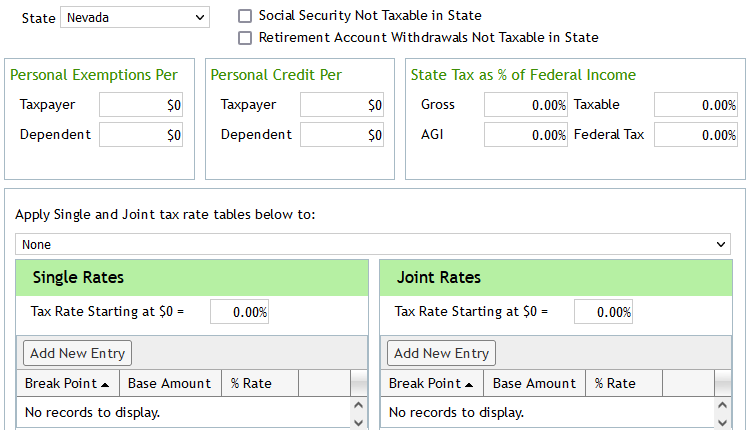

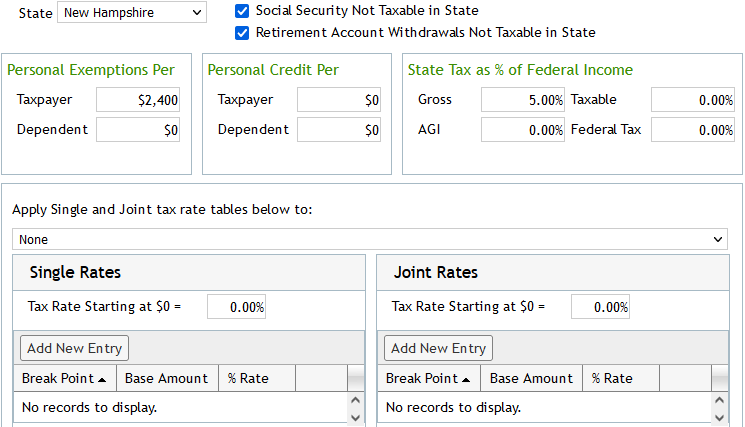

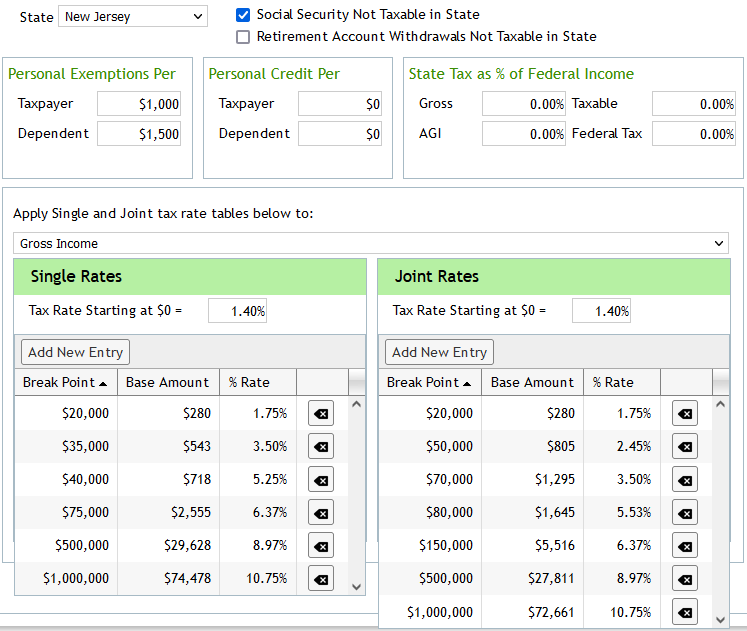

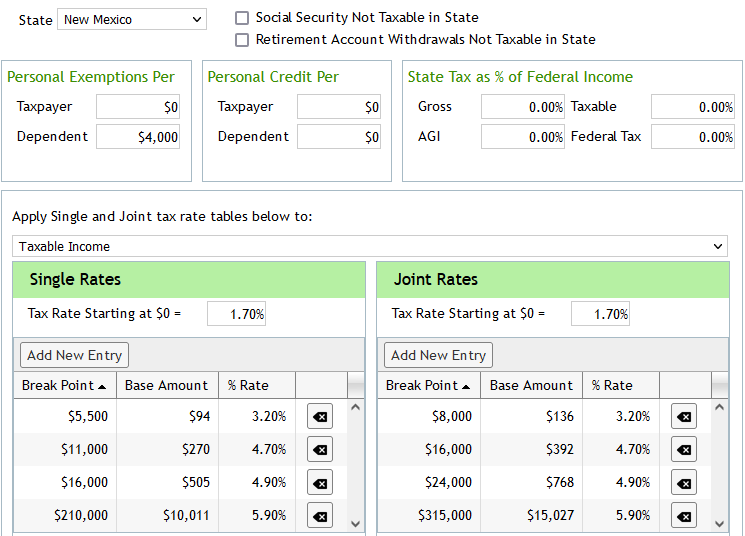

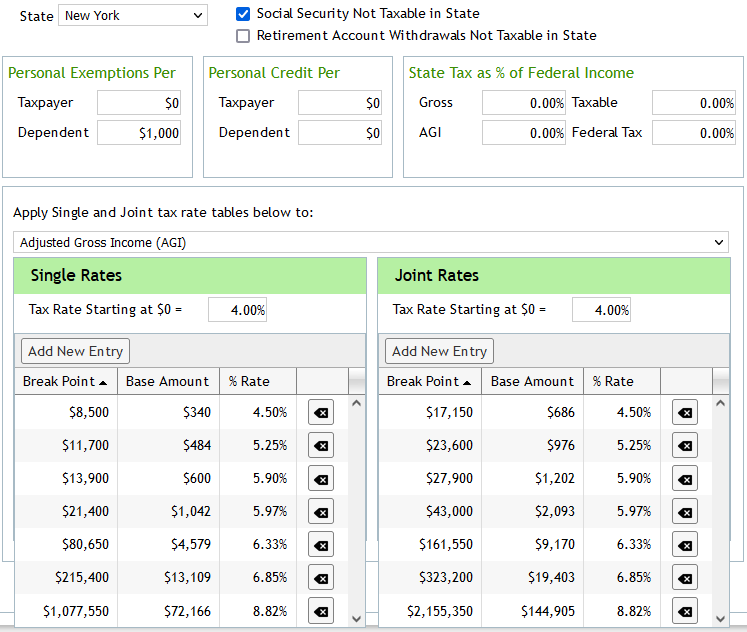

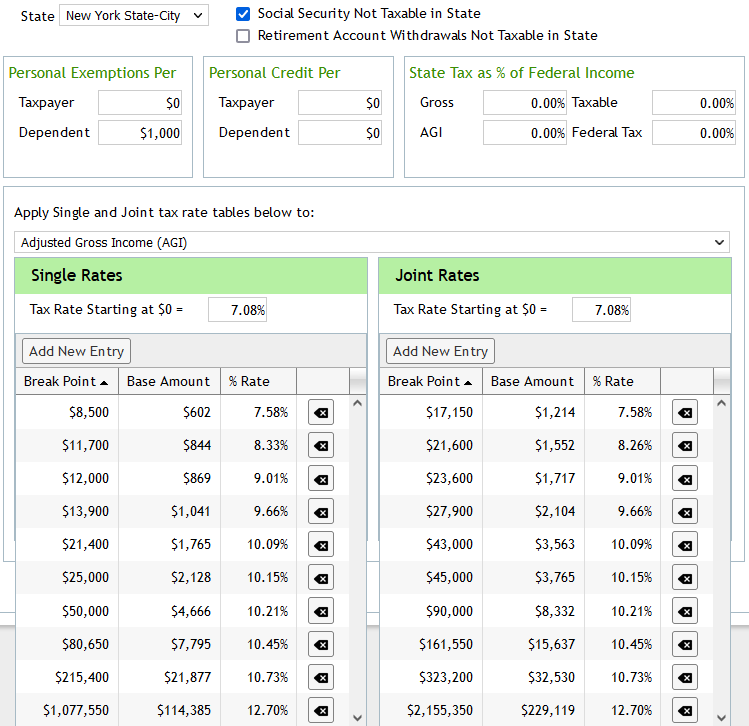

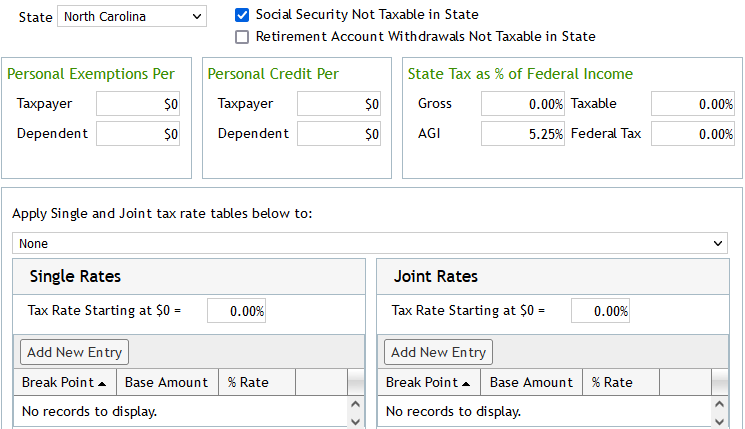

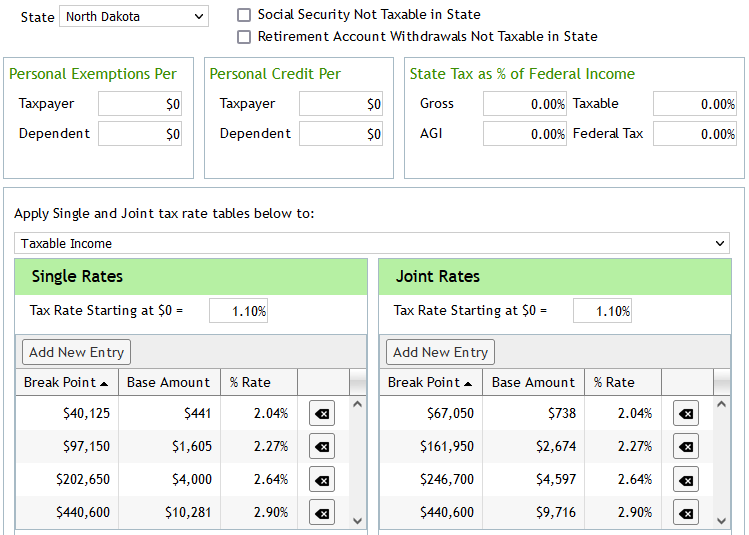

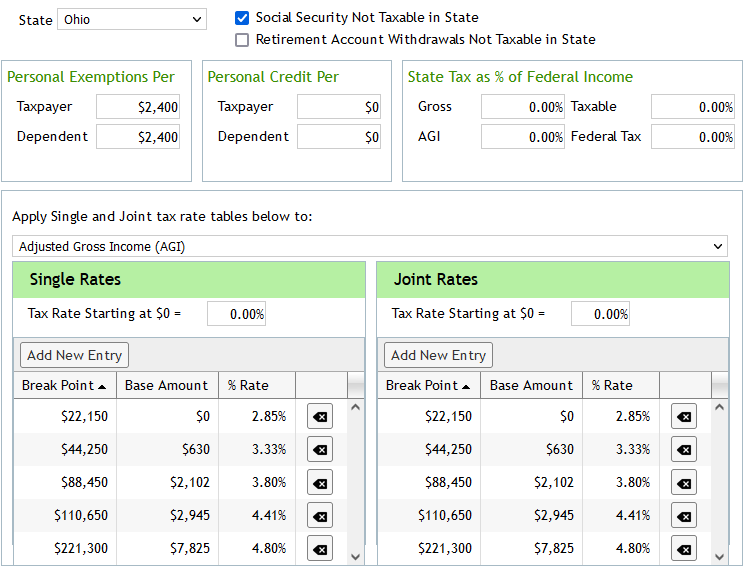

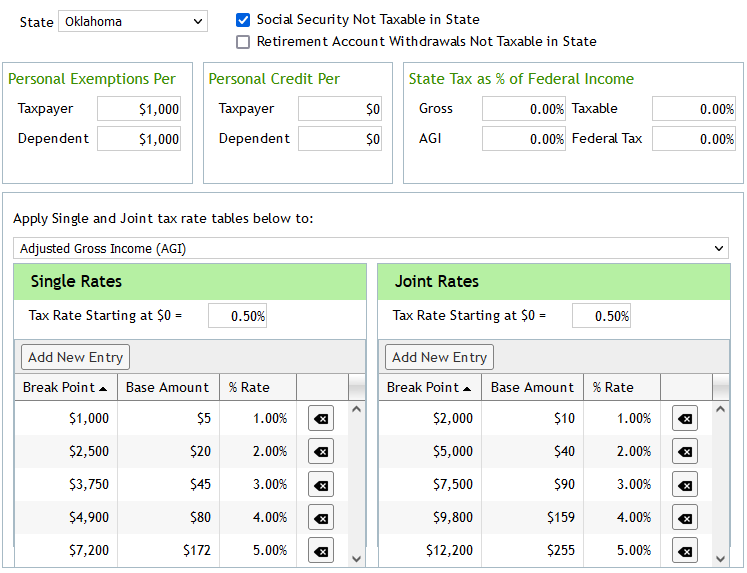

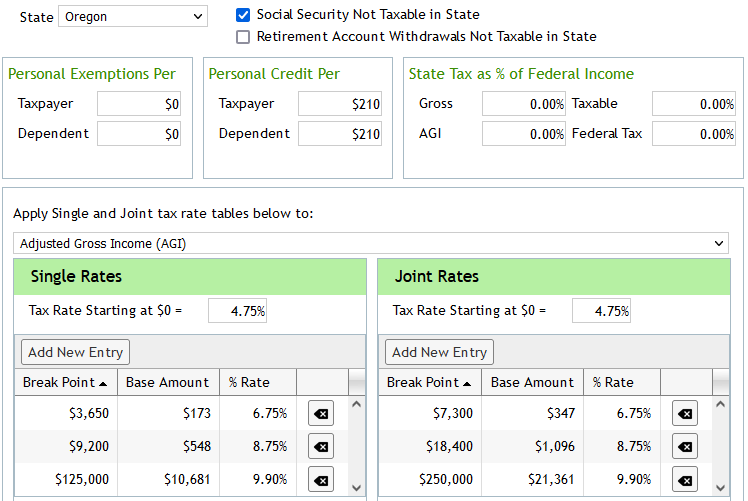

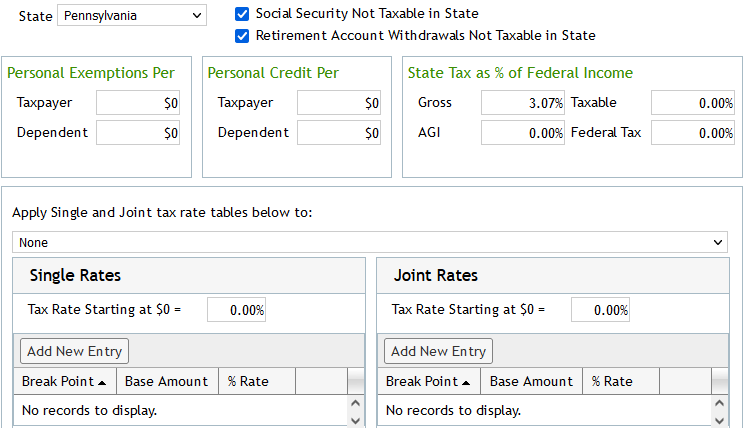

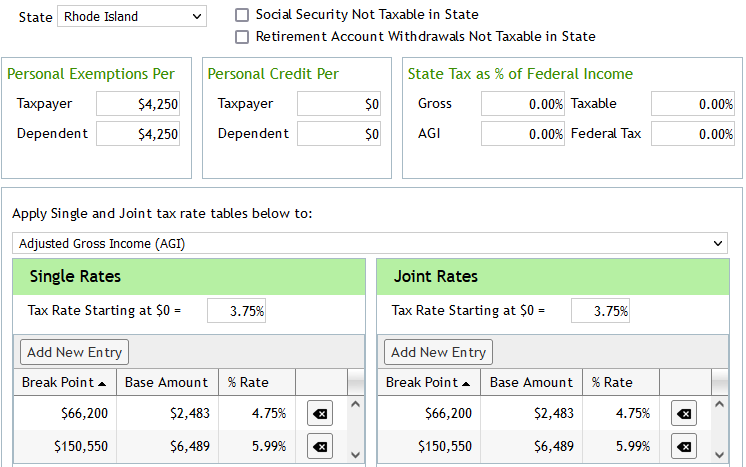

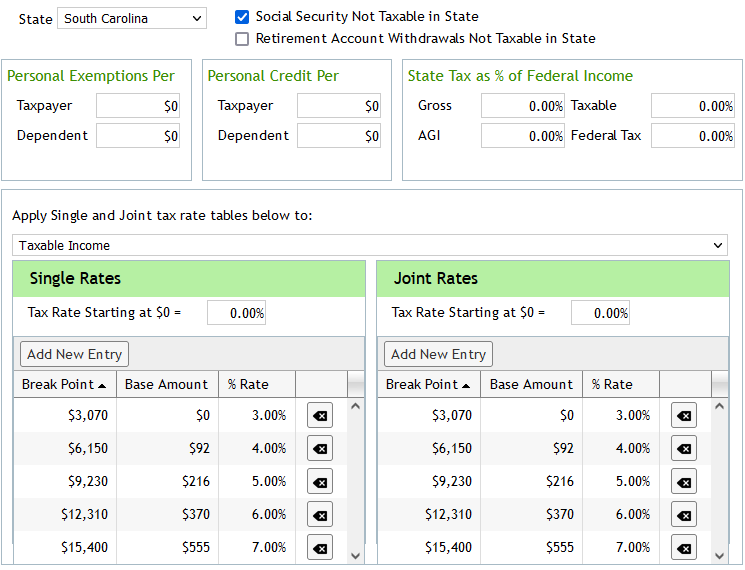

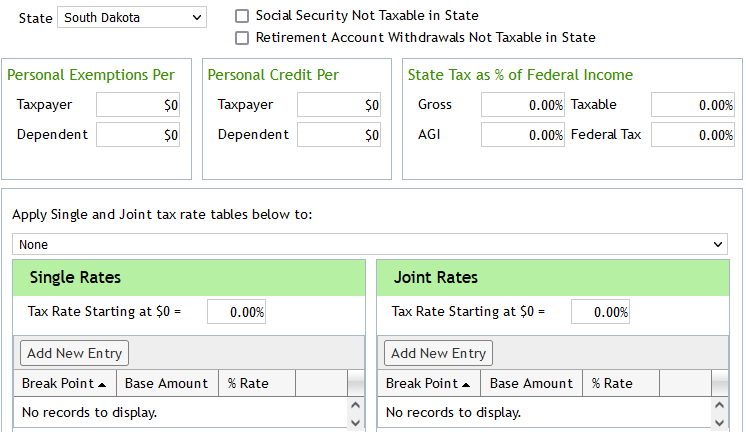

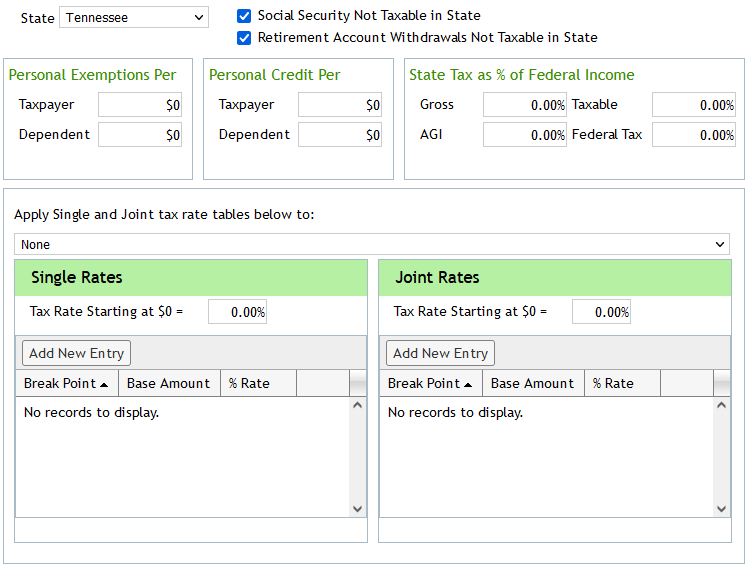

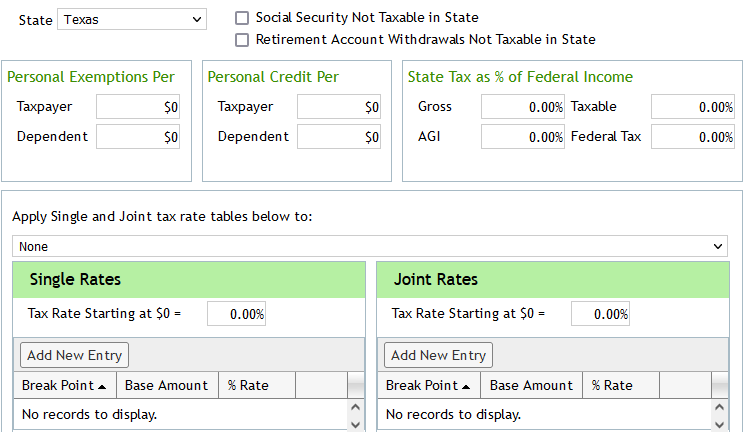

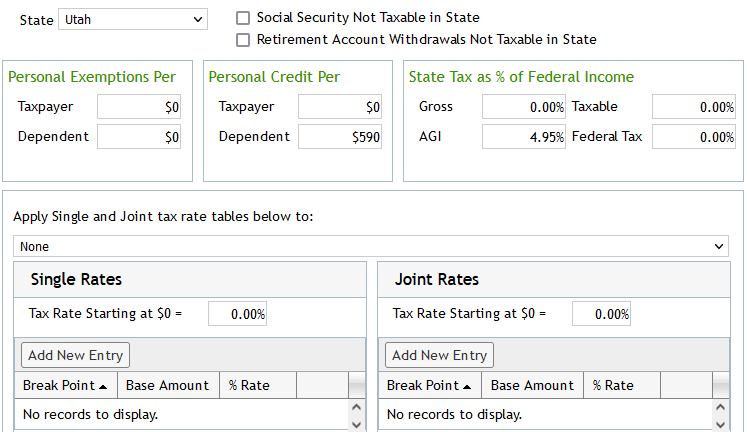

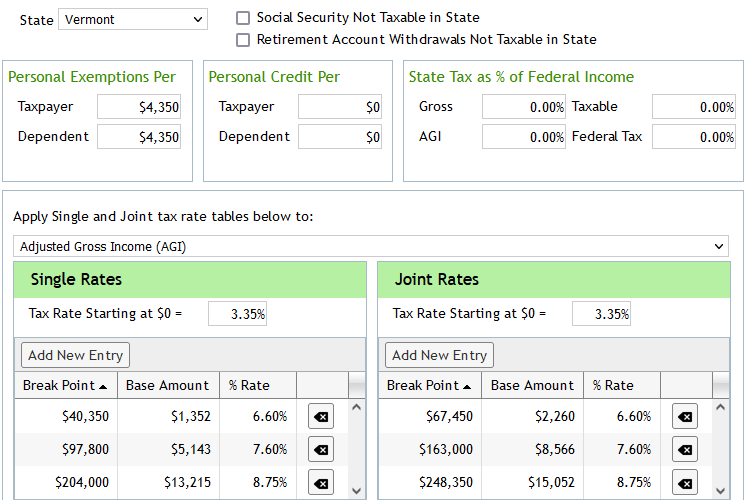

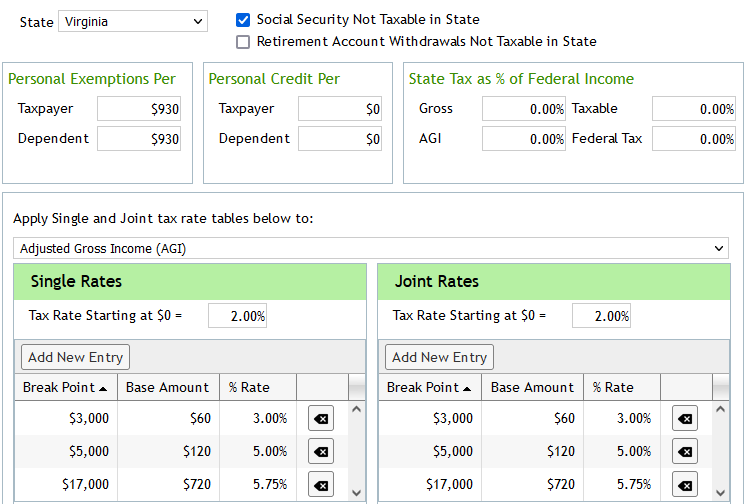

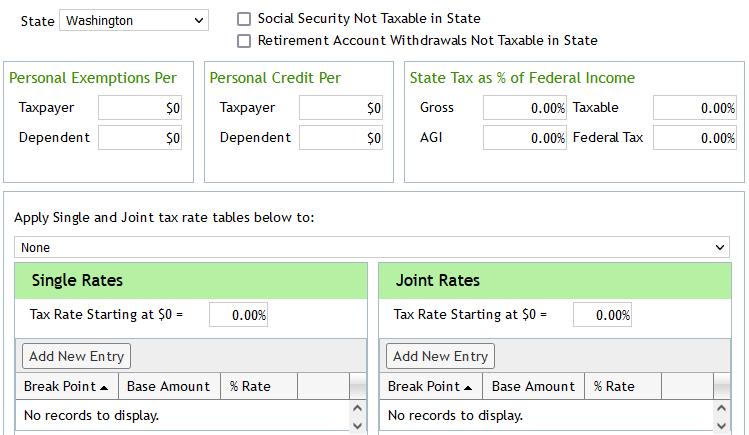

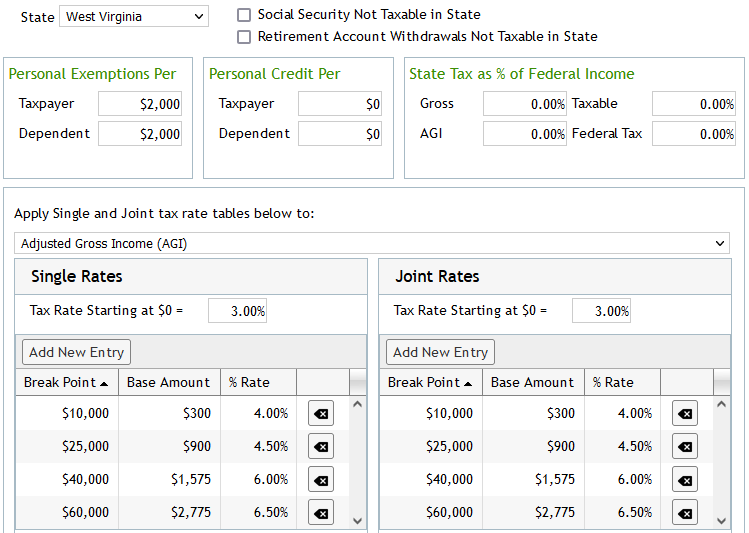

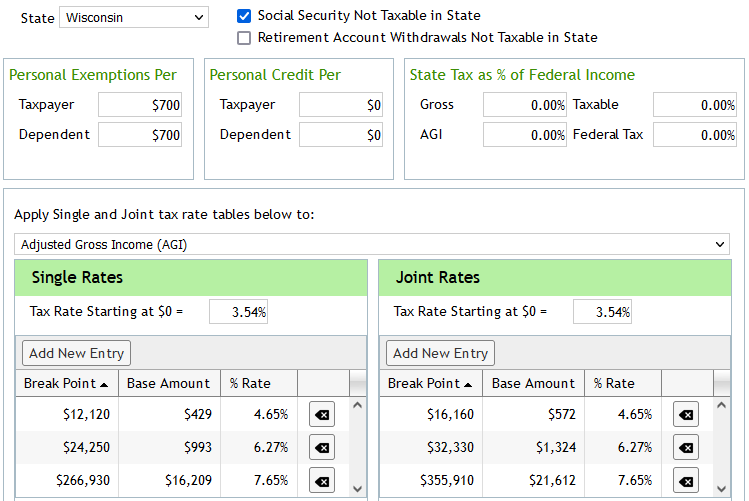

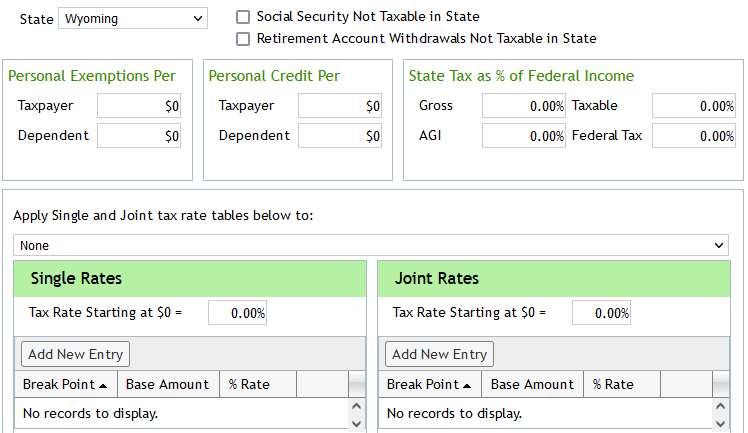

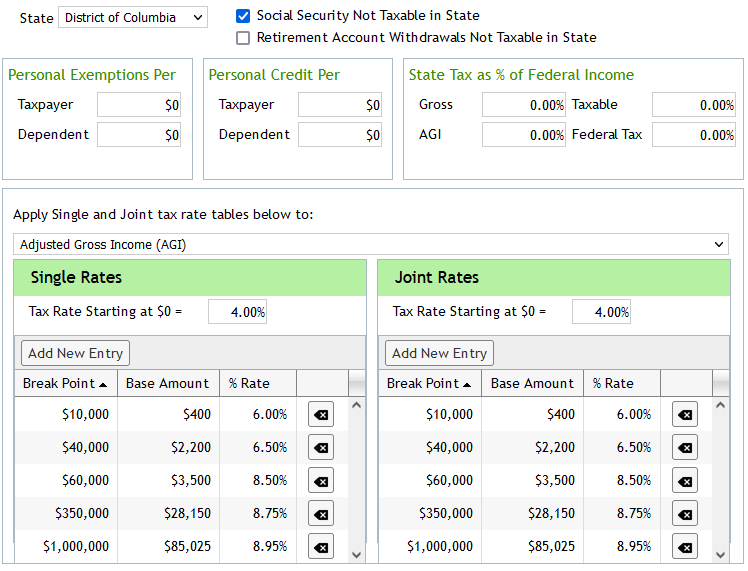

Images of the state tax rates as entered in Moneytree Plan are available below. The tax settings have been entered in a conservative manner. The state tax tables are fully customizable by users in the event that you have preferred assumptions, or if a state makes tax changes we do not catch.

In many states there are standard deductions near or equal to the amount of the federal deductions but do not allow all federal itemized deduction items. For those states, the state tax rates are set to apply to AGI, leaning towards conservative assumptions. Choosing to apply state tax rates to federal taxable income would include all federally allowed itemized deductions (or federal standard deduction if not itemizing) for the state tax calculations.

The option to exclude retirement account withdrawals is not selected for any states that offer partial exemptions of retirement income.

For New Hampshire, which only taxes interest and dividend income, the tax rate is applied to all income except of Social Security and Retirement Account Withdrawals given the availability of those options.

Remember, some adjustments can be made per plan. An option to exclude pension plans taxes on either the federal or state level is available on Pension plan data. Additional adjustments can be made using Tax Details plan data to adjust the client’s state taxable income or tax amount.

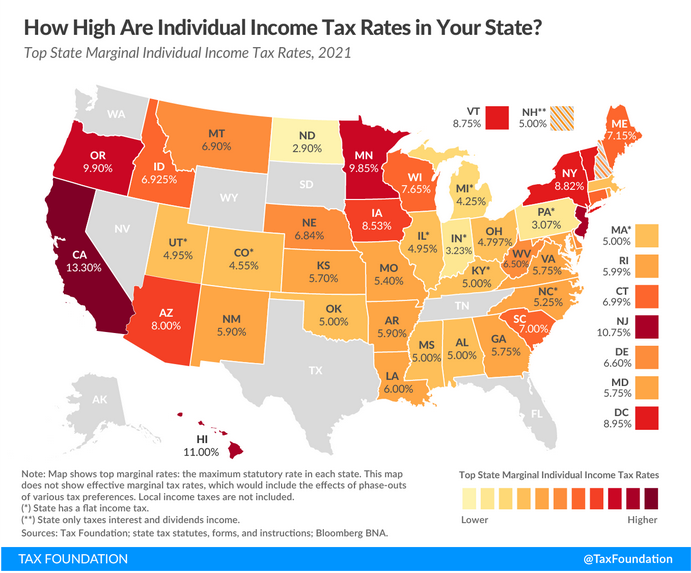

Information Resource:

The Tax Foundation provides summaries of state tax information as well as notable changes for the year: State Individual Income Tax Rates and Brackets for 2021

State Tax Information per State

Jump to State:

AL | AK | AZ | AR | CA | CO | CT | DE | FL | GA | HI | ID | IL | IN | IA | KS | KY | LA | ME | MD | MA | MI | MN | MS | MO | MT | NE | NV | NH | NJ | NM | NY | NYC | NC | ND | OH | OK | OR | PA | RI | SC | SD | TN | TX | UT | VT | VA | WA | WV | WI | WY | D.C.

Alabama

Alaska

Arizona

Arkansas

California

The top rate includes 1% tax surcharge.