There are two methods to implement a reverse mortgage in Moneytree Plan:

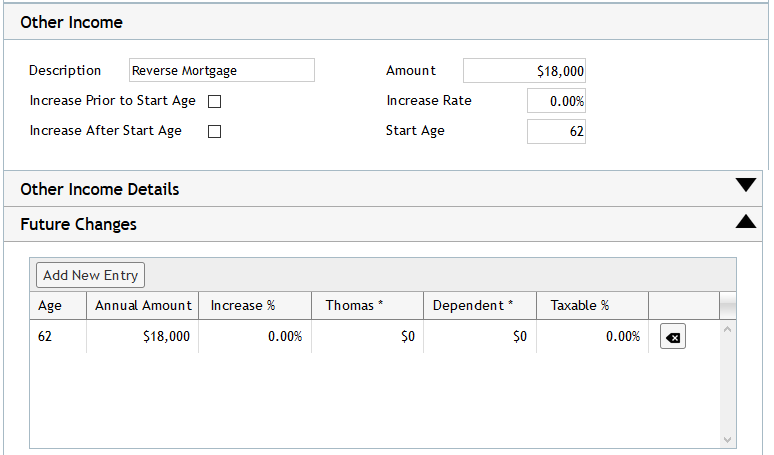

Method 1: Other Income Method

A reverse mortgage can be shown as an extra income stream in the Income section under the Other Income tab.

The advantage of this method is simplicity. This will clearly show the income stream coming into the client from the reverse mortgage on the cash flow and the retirement reports. The disadvantage of this method is that the increasing liability amount is not reflected for the future Net Worth or Estate reports.

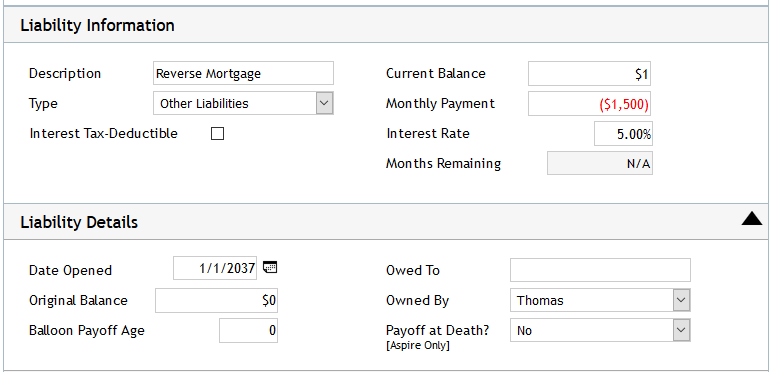

Method 2: Future Liability Method

A reverse mortgage can be entered in the Liabilities input as a future liability with a negative monthly payment. First, add a liability in the Liabilities input, and select “Other Liabilities” in the Type field. Then, enter the date you want to start the reverse mortgage payments in the Date Opened field. Enter an Original Amount of $1, a Current Balance of $1 (the balance will not start until date opened), and put the monthly amount (or 1/12 of the annual amount) of the reverse mortgage payments as a negative amount in the Mo Payment (P & I Only) field. Be sure to enter the Interest Rate expected as well.

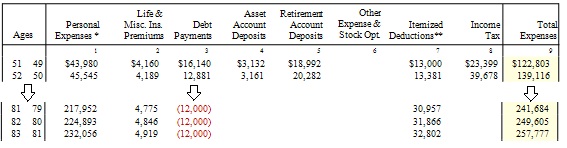

This method will capture the income from the reverse mortgage and track the increasing liability balance. The income is a little harder to see on the reports using this method. The negative loan payments are included on the expense reports, reducing expenses rather than showing as an income stream. See the Annual Expense Illustration report (B8) in Prosper and Annual Expenses (Post Retirement) reports (G4) or Annual Expenses (No Inflation) report (G12) in Aspire.